It’s almost always better to be lucky than good.

Turns out Mighty CEO Mike getting married prevented us from losses (keep reading). And just helped us book a 36% gain — excluding dividends — on Texas Pacific Land Trust Corp. (TPL) in 4 months.

*Disclaimer: We’re still holding a 1-1.25% position in TPL in our portfolio.

How? Well, the inflation trade has been in front of us for over a year now.

Longtime Mighty clients and readers have received countless missives from us talking about the impact of inflation and the consequences of it.

Our job is to do our best to not just weather the storm on behalf of our clients. But to profit from it, too.

That’s exactly what we did with Texas Pacific Land Trust Corp. (TPL) — an oil, natural gas, and water royalty company.

(Texas Pacific Land Trust Corp. is the perfect hybrid company for Mighty clients. It qualifies under 2 of 3 Pillars within our flagship portfolio. It’s both a Trophy Asset company and an Income/Hedge.)

TPL presented a 6.5:1 trade opportunity back in October 2021. One we wrote about to clients. Here’s what we said back then:

“We’re back with another inflation weekly missive.

This time I’ll give you a medium term (6-9 months) trade opportunity. One that offers about a 6.5:1 risk-reward ratio...

There are several reasons I’m bullish on TPL on this trade setup.

First, the royalty business is the best business in the world. There’s no need for capital expenditure, overhead, etc… The drilling company takes care of that. Which means almost all of the royalty revenue flows straight to TPL’s bottom line.

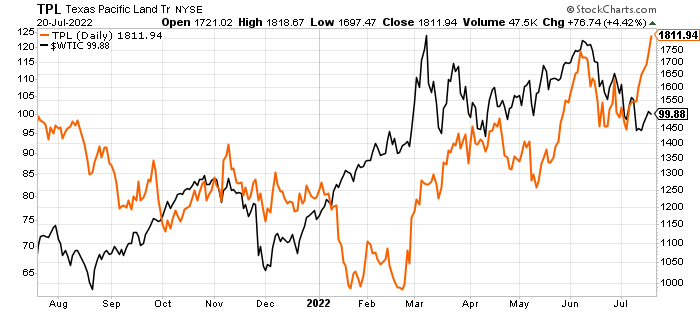

Second, TPL (black line) has sold off about 30% from its highs despite oil prices (orange line) being up 73% year-to-date (YTD). And continuing to make new highs.

Third, TPL used a chart from Chevron’s March 2021 presentation… where Chevron is projecting massive free cash flow generation drilling in the Permian Basin assuming oil’s at $50/barrel. Oil is sitting at $83.76 (as I write)… meaning TPL’s royalty revenue and earnings are about to explode. TPL's price should start to catch up to WTIC (as indicated in the chart above).

Fourth, inflation is here to stay. It’s not transitory. The U.S. government and the Federal Reserve have printed trillions of dollars out of thin air making our dollars worth less. And the country continues to open up, albeit slowly. Both push oil prices up higher.

It wouldn’t be surprising to see a similar story play out. TPL hit a record high of $1,800. It looks to have bottomed at $1,150.

Our upside is at all time highs — 45% higher from here. Our downside is at $1,150 — about 7% lower from today’s levels. If TPL breaks below $1,150, we were wrong about the trade… and we’re out. Giving us a nice 6.5:1 return potential. Those are odds we’ll take all day.”

We didn’t end up putting on the trade for clients in October by accident.

Why? Because we were in Mexico attending Mike’s wedding.

TPL rocketed up 9% to $1,400 the week after our note. The risk reward immediately went to 2:1. So we passed on the trade.

TPL then proceeded to drop to $1,000 through the end of the year.

Oil was already in an uptrend by the time Russia invaded Ukraine late February.

Russia’s invasion immediately pushed oil up to $130/barrel (black line) — up 30%. Yet TPL only went to $1,300 (orange line) — up 18%.

That gave us the perfect re-entry opportunity into TPL.

We started adding to our position throughout March. And a bit more in April. All with the same profit target of its previous all-time highs at $1,800.

Oil prices have remained over $100 pretty much all year. Meaning TPL’s royalty revenue have exploded along with it. Total royalty revenues grew 110% year-over-year in Q1 ‘22 vs. Q1 ‘21.

TPL has been gushing so much free cash they issued a special $20 special dividend for every share we owned — a 1.3% yield at the time. And that’s on top of their regular dividend.

We expect higher dividends and will likely receive more special dividends in the future. Management said as much on their Q1 ‘22 earnings call:

Mighty put on this trade for a specific reason. We had an incredible risk/reward opportunity. The dividends were just a kicker.

You need an exit strategy when you trade. Ours was $1,800. So we’re sticking to that. We sold 1/3-1/4 of our position once it hit the target.

However, upon reassessment, we think TPL has much more upside. From a capital gain and dividend perspective.

U.S. oil and natural gas are becoming increasingly more important on the global stage as Russian sanctions keep their oil off-limits to most of the Western world.

Therefore, we think U.S. oil and natural gas will have a new floor on demand. Some will pay a premium. Especially as we’re heading into the winter.

Our new stop loss will now be the 200-day moving average — around $1,320 as we write. We’ll continue to let TPL run. And collect its dividend moving forward.

Good investing,

Lance

P.S. Shoutout to Mike for getting married and saving us from a quick loss… Instead we helped clients partially lock in 36% gains in 4 months.