Sometimes you just nail a trade.

History shows this trade averaged about a 33% gain in 1-4 months.

We just closed our first tranche for a 44% gain in 17 days.

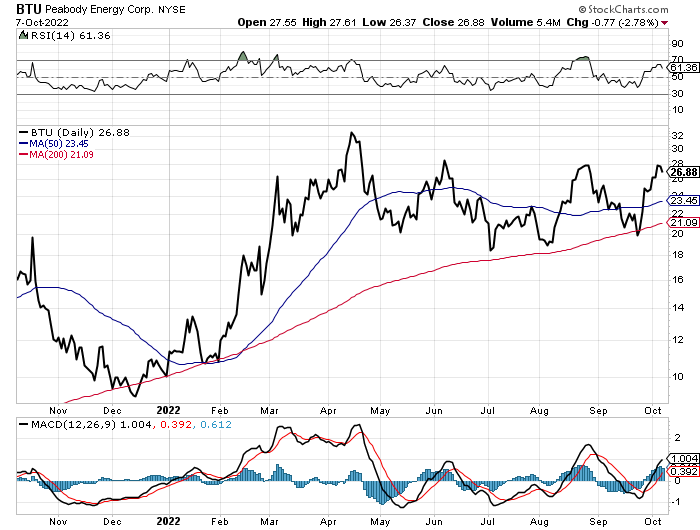

We still hold a 4.75% position in BTU. There’s plenty more juice left to squeeze.

You want to let your winners run. Especially when they’re in an uptrend.

BTU is — and has been — in an uptrend.

And that’s just from a technical perspective.

However, knowing Europe is fighting tooth and nail to increase their storage before the winter, there’s a strong fundamental case for coal.

This fundamental case is what’s making us rethink the time frame to which we hold this position.

Peabody is going to deleverage their balance sheet after pumping so much cash flow. They’ve already reduced their debt by approximately $500 million since 2020.

Here’s their plans from their most recent investor presentation.

They’re expected to have more than $2 billion in cash by the end of this quarter.

So deleveraging will come easy.

This puts their financial position in a significantly better spot. One in which they can start returning capital to shareholders. Either via dividends or buybacks.

Dividends would open up Peabody to a whole new set of income investors.

Buybacks are accretive because they reduce the share count… meaning our ownership percent increases.

The estimates on Peabody put their stock at $45+ — 67% higher from here. These assume a ramp of their Wambo mine. Deleveraging the balance sheet. And increasing their operating cash.

Remember, the fundamental case for BTU is not our base case. We’re trading this stock.

But the fundamental case for BTU gives us significant upside — in addition to potential future dividends.

We took a 44% gain in 17 days. Mighty’s new stop loss will be the 200-day moving average — just above $21. And we’ll continue holding BTU… hoping the fundamental thesis plays out for us along the ride.

Disclaimer: Mighty Invest LLC (“Mighty”) is an SEC registered investment adviser. Brokerage services are provided to Mighty Clients by Velox Clearing, an SEC registered broker-dealer and member FINRA/SIPC. Clients are encouraged to compare the account statements received from the qualified custodian to the reports provided by Mighty Invest. This should not be considered an offer, solicitation of an offer, or advice to buy or sell securities. Please note that to ensure regulatory compliance and for the protection of our investors and business, we may monitor and read e-mails sent to and from our servers. If you are not an intended recipient or an authorized agent of an intended recipient, you are hereby notified that any dissemination, distribution or copying of the information contained in or transmitted with this e-mail is unauthorized and strictly prohibited. Past performance is no guarantee of future results. The research is based on current public information that Mighty Invest considers reliable, but Mighty Invest does not represent that the research or the report is accurate or complete, and it should not be relied on as such. The views and opinions expressed in this are current as of the date of this email and are subject to change. The information provided is historical and is not a guide to future performance. Investors should be aware that a loss of investment is possible. The securities identified do not represent all of the securities purchased, sold, or recommended for clients. It should not be assumed that investments made in the future will be profitable or will equal the performance of the securities referenced. Additional information, including (i) the calculation methodology; and (ii) a list showing the contribution of each holding to the portfolio’s performance during the time period will be provided upon request. The information transmitted is intended only for the person or entity to which it is addressed and may contain confidential or proprietary material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender and delete the material from all computers. The sender does not accept liability for any errors or omissions in the contents of this message which arise as a result of this email transmission.