You can finally feel it.

Optimism and hope have turned to pessimism and despair.

Longtime Mighty readers and clients know we’ve been preaching caution since November.

We’ve said the markets’ momentum was like a falling knife for eight months. Try to catch it and you’ll get hurt.

Our most recent word of caution was our April 26th post What Do We Do Now?:

“Where the market goes from here is anybody’s guess. That’s what makes a market. But the warning signals continue to skew the probabilities to the downside in our opinion.”

The S&P500 and Nasdaq have fallen another 5% and 8% since. And are now down approximately 17% and 28% from their peak.

Most investors have learned the hard way by buying the dip. Over $7.5 trillion in wealth has evaporated from the Nasdaq this year alone. More than the 2020 COVID-19 crash. More than the 2007-2008 Great Financial Crisis. And more than the 2000 dotcom bubble burst.

So are we headed much lower? Where’s the bottom? What do we do now?

We don’t know. But we’ve finally seen a change in sentiment.

Sentiment is outright bearish. The CNN Fear & Greed Index now stands at 11.

It was at 40 on April 26th when we last wrote about the state of the markets in What Do We Do Now?

Things can get more bearish. Markets can continue to sell off. The knife is still falling. But we’re seeing signs of peak pessimism today.

Fund managers are now the most underweight tech stocks they’ve been since August 2006 according to Bank of America’s Fund Manager Survey. BofA’s survey also showed global growth optimism at all-time lows… and global growth pessimism at all-time highs.

Pulled from Whitney Tilson’s daily e-letter, Empire Financial Daily (which we recommend reading):

“Last week Investors Intelligence indicated that Bulls fell to just 29.8, the lowest since early 2016 while Bears rose to 40.8, the highest since March 2020.

Tech stocks are on the longest losing streak (seven weeks) since the dot-com bubble burst, and the Dow is on the longest weekly losing streak since 1923.

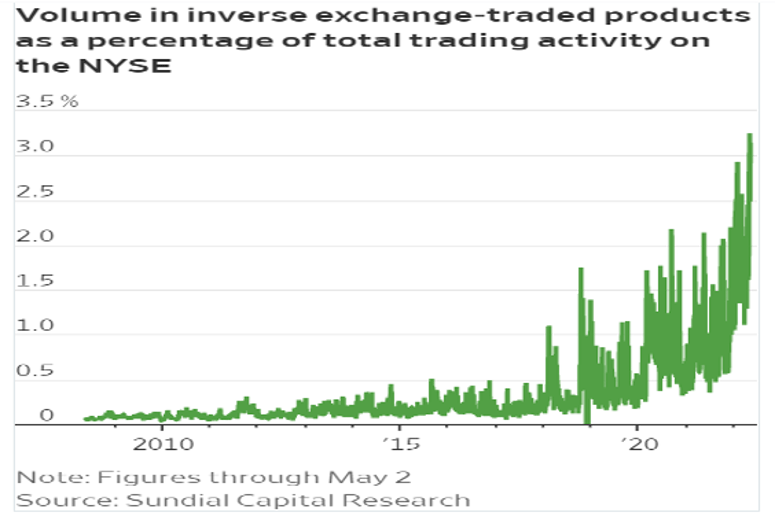

[Also] the volume in inverse ETFs (at 3.25% of total trading) is at an all-time high.”

Human emotions are very animalistic. We have this herd mentality.

We follow the herd when everyone is bullish. And we follow the herd when everyone is bearish.

But the market turns when there are more buyers than sellers. It’s as simple as that.

The markets are forward-looking.

They’re selling off in anticipation of a U.S. recession. Of the Fed raising rates and removing liquidity. Of inflation. Of a persistent Russia-Ukraine conflict. Of global supply chain issues. Of China lockdowns.

Markets hate uncertainty. So it’s understandable stocks are much lower (as are all asset classes).

However, these are known-unknowns.

Everyone knows about these. And have positioned their portfolios as such.

What the markets haven’t positioned for are any positive developments:

If U.S. consumer spending remains strong;

If inflation isn’t higher for much longer;

If there’s a Russia-Ukraine ceasefire;

If China ends its lockdowns.

No one knows where the markets are heading. No one knows how the markets will react to certain events — positive or negative.

Like the market making a V-recovery during COVID-19 and then doubling off the lows.

Well-known investor Bill Miller from Miller Value Funds said in March:

“Last week, attention has turned from guessing how much lower stocks can go to guessing whether the rally can be sustained and by how much? The important point to keep in mind is both exercises are just guesses. No one has privileged access to the future, a future which involves what Keynes called irreducible uncertainty.”

This still holds true. Probably more so today than in March.

Except markets are much lower. And uncertainty is much higher.

If the idea of you buying stocks right now makes you sick to your stomach… That’s usually a sign we’re closer to the bottom now.

So, are we close to the bottom? Is it time to buy the dip?

Who knows. Some companies are trading at incredible prices. We’re starting to put a bit more capital to work — although we’re still very defensive.

Remember, stocks are ownership stakes in real businesses. Getting the ability to buy them at great prices is the exact reason we invest in the first place.

But what you do now depends on how well you’ll be able to sleep at night. Here’s what we said back in April:

“Would you panic if your portfolio dropped another 30%? If so, you’re overexposed.

It doesn’t matter if you’re sitting on losses in some of your positions… It’s not too late. You just admitted you can’t withstand more pullback psychologically. (Don’t worry, 99% of us can’t either.)

If the rest of these Generals get shot, you can guarantee the rest of tech will get slaughtered. (Yes, they can go down further. Remember, a stock that falls 90% first, falls 80%… then it gets cut in half).

Irrational selling or not. This is the market we’re in. You have to adapt to the market. It won’t adapt to you.

That’s where having an allocation to cash may help you sleep well at night. Capital now allows you to weather the storm. It’s purely psychological.

Because, truth is, you can’t time the market. Even if you can predict what’s going to happen, you can’t predict the real probabilities. Or the second or third order consequences. (Think: The markets booming because of COVID in 2020.)

Historical data suggests you shouldn’t touch your portfolio. Interrupting the effects of compounding crushes your long-term returns. So doing nothing is often the best move. Meaning stop looking at your stock performance everyday and potentially doing something stupid (i.e. selling).

But you need to do what’s best for you.

Anything to control your emotional level during times of high volatility. If that means raising cash and reducing your potential future returns. So be it.

Whatever you need to do to sleep well at night.”

You won’t be able to time the bottom. Expect that the stock, index, or ETF can/will go down another 10%+… Volatility will remain high for a long time. Chances are we have lower to go before the actual bottom.

But get your watchlist back out. Look through them. And start thinking about adding to the positions. We think you’ll likely be happy with that decision 3-5 years from now.*

Good investing,

Lance

P.S. One of those stocks we think will do well over the next 3-5 years is Roku — one of our top Disruptor holdings.

We wrote two long pieces. You can read Part I here and Part II here.

*Disclaimer: Of course, not all stocks will rise 3-5 years from now. The point we’re making is many companies stock prices have been crushed. Their valuations are cheap relative to their historical averages. So the upside is worthwhile.

Thank you for reading Mighty’s Newsletter. This post is public so feel free to share it.