The asset carnage isn’t likely to be over.

And the Federal Reserve doesn’t care how much more wealth of yours they have to destroy in order to get inflation back to their 2% mandate.

Federal Reserve Chairman Jerome Powell made that very clear during his press conference last Wednesday… after the Fed raised interest rates 75 basis points — the most since 1994:

“We won’t declare victory until we see a series of consecutive, sharp declines in the monthly rate of inflation.”

Powell also said:

‘‘We’d like to see positive real interest rates across the entire curve. That will make us more comfortable that inflation will be slowing down.’’

You see, the Federal Reserve committee and the entire U.S. government have a lot of egg on their face.

They’ve been saying inflation was transitory throughout all of 2021 and early 2022.

They can’t deny it anymore. Inflation hasn’t come down. It’s accelerated.

Meaning they will do whatever it takes to bring it down… and save their credibility.

“I was wrong about the path inflation would take.” Treasury Secretary Janet Yellen said in a CNN interview with Wolf Blitzer.

St. Louis Fed President James Bullard said, “I think we’re on the precipice of losing control of inflation expectations.”

Here’s former Treasury Secretary Larry Summers:

It’s a rare sighting to see the number of “I’m sorry’s” and “I’m wrong’s” from these higher up government officials.

It was just three months ago (March) that James Bullard was the only member suggesting they raise the Federal funds rate above 3%, by December.

Now, every single member is projecting 3% or higher.

What an about-face!

So what should we expect moving forward?

Unfortunately, it seems like there’s going to be a lot more carnage.

Asset prices — stocks, bonds, and crypto — have collapsed. Real estate has cooled. But they could all fall further.

This time, the Fed is willing to put millions of people out of work. Their tightening of financial conditions is already well underway.

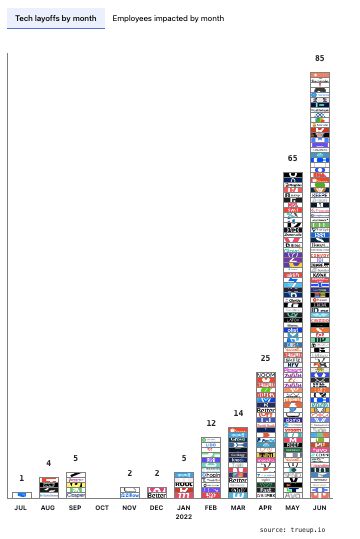

We’re seeing the layoffs in the tech space accelerate. Below is the number of tech companies who have laid off workers over the past 12 months.

25 tech companies laid off workers in April. 65 in May. And 85 so far in June.

Said another way: There have been over 3x more layoffs in June (midway) than in April. And 17x more company layoffs in June versus January 2022.

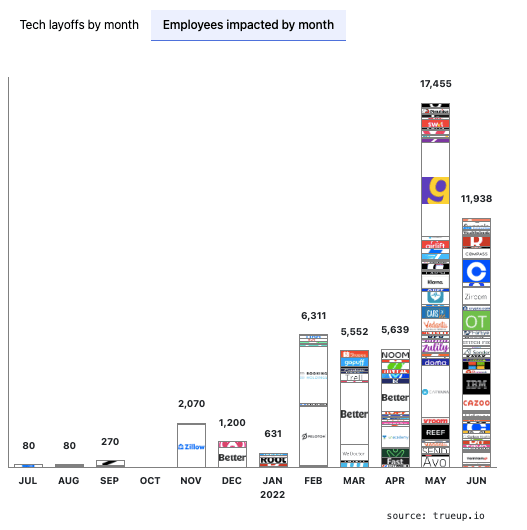

Here’s the number of employees laid off from those 85 companies:

Just over 17,500 lost their jobs between February - April.

Nearly 17,500 people lost their jobs in May alone. Another ~12,000 halfway through June. Meaning 24,000 people are projected to lose their jobs this month — 4.2x more than April.

This is the catch-22 we discussed last week.

Raise interest rates to tackle inflation. But put millions of people out of work. (And this is just the tech sector.)

The Fed knows this. But is choosing to fight inflation.

Which they should… because everyone gets hurt during recessions. Especially the lower to middle class.

From Bloomberg (emphasis added):

“As prices for everyday expenses go up, more families are going without. Some 31% of households found it somewhat or very difficult to pay for usual household expenses, according to a Census Bureau survey conducted in late April and early May, compared with 25% at the same time last year. Nine percent of households sometimes or often didn’t have enough to eat, the survey found, compared with 7% a year ago.”

Meanwhile, energy prices aren’t just hitting people at the gas pump… they’re putting people in debt. Again from Bloomberg (emphasis added):

“The challenges are especially acute for low-income Americans who spend more of their income on necessities. Gasoline and power bills now account for about 34% of the monthly budgets for the lowest-earning consumers, up from 31% last year, according to the National Energy Assistance Directors Association.

The cost of energy is becoming unaffordable,” said Mark Wolfe, executive director of NEADA. US consumers currently owe about $22 billion in overdue utility bills, almost double the $12 billion seen in a typical year. This all comes at a time when housing prices are also surging, up the most since 1991 as of April. Shelter costs lag other CPI categories because of how the government tracks the data, so the category could increase further in the second half, adding to household strain.”

That is why the Fed is so focused on tackling inflation.

But, of course, there are consequences.

Here’s Tom Hoenig, former Kansas City Fed president at the Strategic Investment Conference (emphasis added):

“I think that the FED will push until unemployment starts to rise too sharply in their opinion. If the unemployment rate starts to rise to 5% or more, I think that they will back off.

“Now, I hope that if they find themselves in that circumstance, they will pause and not reengage in quantitative easing or lower interest rates just to get us out of the slowdown that is inevitable, given where we’re starting from with 8%‒8.5% inflation almost. And I think if you look at Powell’s spring 2019 actions, when the market threw a liquidity tantrum in the reverse repo market and so forth, his inclination will be to step in. It will take a lot of discipline on his part and on the FOMC’s part to say, ‘Wait a minute, we may pause, but we’re not going to stop. We’re going to pause in terms of raising interest rates, but we’re not going to reduce them and we’re going to have to get through this. And yes, unemployment’s going to be higher.”

Unemployment stands at 3.6% as of May 2022.

If Hoenig is right, another 2+ million people will lose their jobs before the Fed even thinks about pausing the interest rate hikes.

That’s what “whatever it takes” means.

Mike and I aren’t macroeconomists. We’re not in the business of predicting recessions.

We’re simply pointing out that the Fed is hellbent on tackling inflation.

And are willing to destroy people’s wealth until they see inflation abate.

That means lower stock prices. Lower bond prices. Lower crypto prices. A housing cooldown. Alternative asset cooldowns.

(Mike and I aren’t predicting where the markets will go either — rather the probabilities continue to skew to the downside.)

The Fed has already destroyed $10+ trillion in wealth. But this is the first time they’ve publicly admitted to not caring about wealth destruction. Which is a complete 180 from the previous 22 years where they’ve saved people’s wealth — hence the term “The Fed Put.”

We’ve been warning longtime readers and clients the knife is falling for 8 months now. And to raise cash like we have.

Because the truth is, we’re truly in uncharted territory. Volatility isn’t going away anytime soon. And anyone predicting they know where and when the bottom is… is guessing or lying.

Survival is what’s most important in a market like this. We’re seeing the layoffs and corporate bankruptcies right in front of our eyes. With more to come.

So it’s best to have cash for two reasons:

To buy great companies at incredible prices once the knife stops falling.

Cash is what will allow you to make it through this volatility. Make sure you continue to have some. For yourself. For your family. And for investment opportunities.

Good investing,

Lance

P.S. The Mighty Portfolio hasn’t been immune. We’ve taken it on the chin just like everyone else. But our 3 Pillar Strategy: Disruptors, Trophy Assets, and Income/Hedges were built exactly for this environment. And have been a relative saving grace in this volatile market. It’s what keeps us invested no matter what.

If you’re interested in learning more about our portfolio composition and/or becoming a client, reply back to this email and we’ll set up a call.