You can’t help when a quote gets misquoted.

In fact, Peter Lynch — one of the most famous and successful mutual fund managers of all time — had to backtrack as a result.

Lynch ran Fidelity’s Magellan Fund from 1977-1990. He managed an annualized return of 29.2% — doubling the performance of the S&P 500.

He later wrote the book One Up On Wall Street (1989), which is required reading for anyone that’s getting into the world of finance.

The book is filled with great investment wisdom on how to identify and invest in multi-baggers.

One of the main ones is “invest in what you know.”

Lynch gave a couple examples on monitoring which products his wife was talking about or buying (Companies like Ulta and TJX if I recall).

Then he’d dig in. Buy. Then hold.

He credits this as a primary catalyst to his returns.

But the issue is mainstream media and the general investing population took that advice too literally.

Good products or services don’t always make good investments.

We’ve talked about it before when highlighting Bed Bath & Beyond (BBBY) and Blue Apron (APRN).

Another company investors continue to get burned by on is Spotify (SPOT).

There really isn’t a musician or podcaster who doesn’t post their music or podcast on Spotify.

Spotify is the global market leader — with 31% market share according to Forbes. Apple Music is second with 15%.

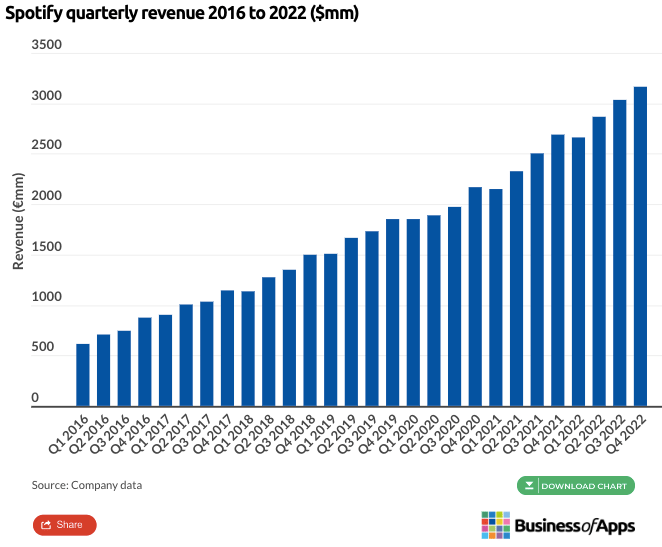

Spotify has almost 500 million monthly active users — 41% of which are premium subscribers paying a monthly fee for no ads. It generated almost $12 billion in revenue in 2022.

Take a look at its revenue growth since 2016.

COVID-19 accelerated the streaming trend. The number of podcast listeners jumped 40% globally in the same period, according to EMarketer estimates. Its advertising doubled between 2019-2021 in the U.S. alone, according to PwC.

Analysts project total advertising revenue in the podcasting industry will reach $4.3 billion by 2024.

So what investor wouldn’t be excited about Spotify’s revenue growth and the secular tailwind behind it?

The big issue… Spotify has never made a net profit in its history.

Despite growing quarterly revenues 6x over the past six years… its gross profit margins haven’t budged — ranging in the mid-20s.

Spotify’s service is fantastic. There’s a reason it’s the leader in both music and podcasting. There’s a reason Apple hasn’t closed the gap.

But that doesn’t mean it’s a good investment.

In fact, Spotify hasn’t made money for investors since it went public in 2018.

Investors continue to get lulled into the Lynch fallacy — invest in what you know.

This advice gave people a pass to look under the hood and do fundamental research. And scapegoat Lynch’s advice for potentially underperforming.

It forced Lynch to later recant his advice saying:

“I’ve never said, ‘If you go to a mall, see a Starbucks and say it’s good coffee, you should call Fidelity brokerage and buy the stock…’

‘People buy a stock and they know nothing about it,’ he says. ‘That’s gambling and it’s not good.’”

There’s millions of data points that suggest one strategy or another leading to successful investing… but that doesn’t mean you can duplicate it in a copy/paste manner and expect to crush the market.

Investing isn’t supposed to be easy. If it was, everyone would be rich.

Good investing,

Lance