“When I was a boy, there was a popular saying: Don’t just sit there; do something. But for investing, I’d invert it: Don’t just do something; sit there. Develop the mindset that you don’t make money on what you buy and sell; you make money (hopefully) on what you hold. Think more. Trade less. Make fewer, but more consequential, trades.” - Howard Marks

Most people know of, or have heard of, the power of compounding.

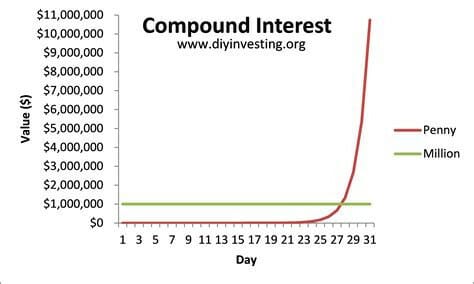

Maybe you’ve heard of the theoretical “would you rather have $1 million or a penny doubled every day for 30 days?”

You choose the penny if you knew the power of compounding.

Compounding only works with time.

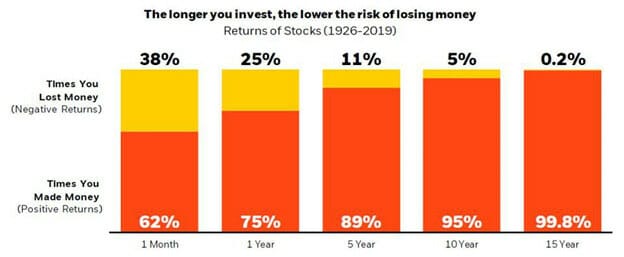

Your chances of losing money pretty much go to zero if you hold long term, too.

Most investors know this… yet they can’t help but get in their own way. The average holding period of a stock is six months.

The result of our erratic behavior to buy and then sell leads to a three percentage point underperformance relative to the S&P 500, according to a 2012 DALBAR Institute study.

We continue to self-sabotage because we’re emotional creatures. Ones who feel the need to take action with every piece of information that comes our way.

Our other guess is investors really don’t know thyself. They don’t know the investing game they’re playing. They call themselves long term investors… but truly they’re speculating, by looking for a quick buck.

Here’s what we said December 22nd, 2021 titled Know The Game You’re Playing:

The data all shows one thing… if you want to make a lot of money, you really don’t want to do anything. Especially with your Trophy Assets.

(Speaking of, Trophy Asset holding Zoetis (NYSE: ZTS) announced they’re raising their dividend another 15% this year. The compounding effect applied to increasing dividends is also a thing of beauty. See here.)

Legendary investor Howard Marks makes a good analogy to short vs. long-term buying in his most recent must-read memo What Really Matters:

“Buying for a short-term trade equates to forgetting about your sports team’s chances of winning the championship and instead betting on who’s going to succeed in the next play, period, or inning.”

He then goes on to say (emphasis added):

“Obviously, no one should attach much significance to returns in one quarter or year. Investment performance is simply one result drawn from the full range of returns that could have materialized, and in the short term, it can be heavily influenced by random events. Thus, a single quarter’s return is likely to be a very weak indicator of an investor’s ability, if that. Deciding whether a manager has special skill – or whether an asset allocation is appropriate for the long run – on the basis of one quarter or year is like forming an opinion of a baseball player on the basis of one trip to the plate, or of a racehorse based on one race.”

Warren Buffett is worth approximately $110 billion. But 99% of his net worth came after the age of 65.

The average 100-bagger return takes around 20-25 years. That’s a long time to wait.

Our ability to wait that long anymore is almost impossible. We can’t comprehend what the future will look like 20 years from now. Let alone next year. It’s also because our ability to think that far into the future still feels new for human evolution.

Every part of our being tells us to do something.

No one ever tells us to do nothing.

But that’s the only way to watch the power of compounding work.

Good investing,

Lance