“Money flows where it’s treated best.”

It’s intuitive and simple, yet powerful. Powerful enough to help you understand where stocks, bonds, and other assets will trend.

It’s one of the first lessons I (Lance) learned from my previous employer.

Longtime readers may recognize this quote.

We wrote about it April 2022 in our missive, Why Mortgage Rates Are Rising (emphasis added):

The answer has to do with U.S. bonds.

The U.S. government is considered the safest institution in the world.

It has the strongest economy. The backing of the U.S. taxpayer. And the strongest military.

Lend your money to the U.S. government and you’ll get paid back. Uncle Sam has never missed an interest payment or failed to pay back your principal.

That’s why U.S. bond yields are considered the “risk-free” rate…

Any person, company, country or entity that’s looking to borrow will have some form of risk premium relative to the U.S. government.

What does that have to do with mortgages?

Well, there’s a risk premium lending to individual people too.

Banks are looking for yield. Just like the rest of us.

They have the option of buying U.S. bonds. Or lending money to homebuyers. (Among other places: like companies, etc.).

Therefore, banks assess the risk premium needed to offset lending to you vs. lending to the U.S. government.

So the bank has to make a decision whether to lend money to the U.S. government or the homebuyer.

They calculate the risk premium based on your income. A probability of you losing your job. Your assets. Liabilities. Credit score. Etc.

So as the Federal Reserve has raised interest rates… The 10-year U.S. Treasury yield is moving up alongside it.

Since banks use the 10-year U.S. Treasury yield as a proxy for risk… the risk premium on individuals goes up too.”

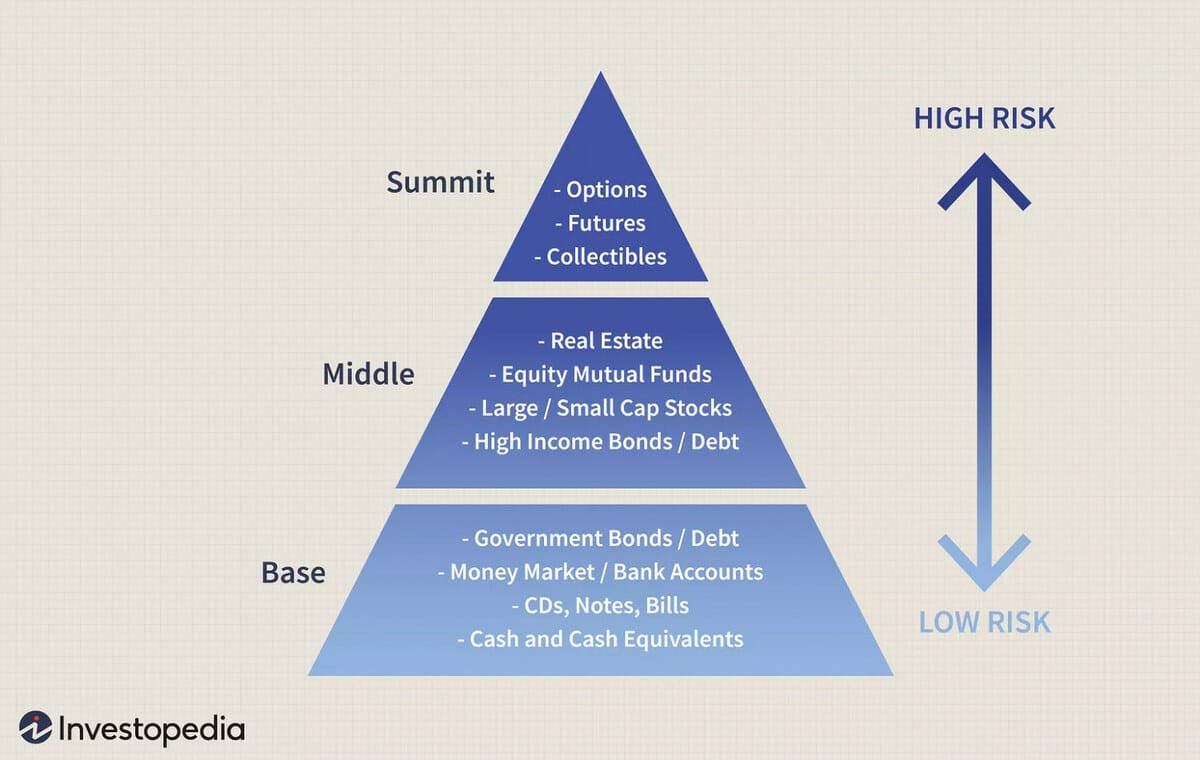

The common investment risk pyramid looks like this:

You see, the rational investor makes an assessment on risk.

Notice money market funds considered one of the lowest risks “assets.”

Many money market funds are now paying 4-4.5%+ yields.

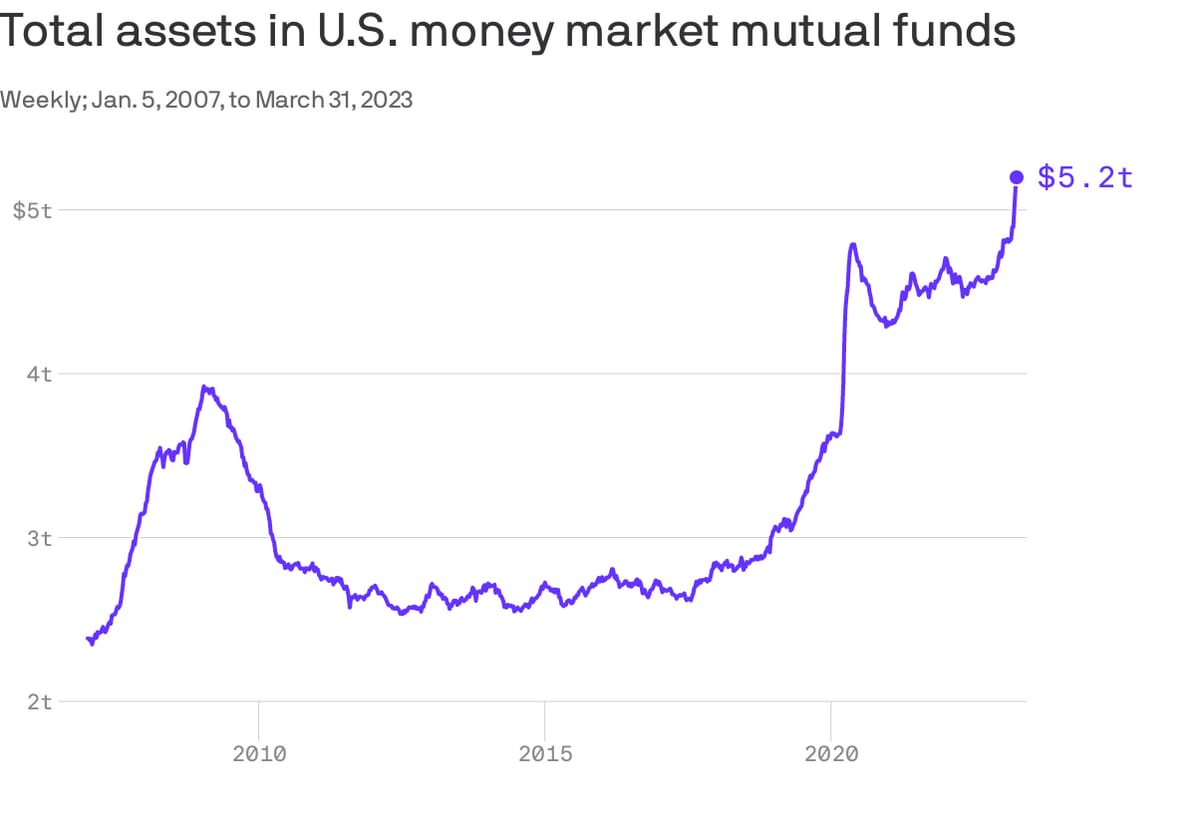

It’s why there’s been a flight to money market funds.

Nearly $500 billion has flowed into money market funds since mid-March 2022 (when the Federal Reserve started raising interest rates).

More than half — $300 billion — of that has come in the last three weeks.

The flight to money market funds is obvious.

Why risk money investing in a stock’s 4% dividend — where there’s company and stock market risk, among others, for example — when you can earn 4%+ on an instrument similar to cash?

This is great for the individual. They can now earn money on their cash again.

However, there are consequences here, too.

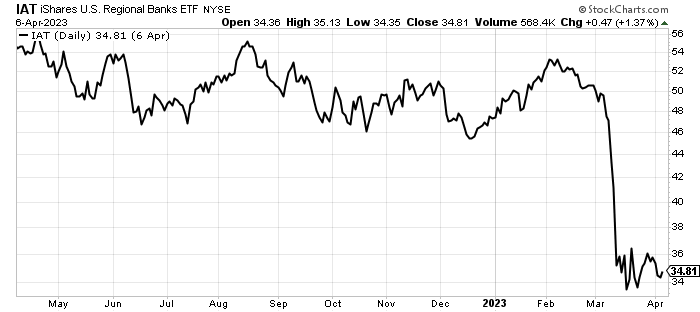

1) Bank Stocks Get Crushed

There’s an exodus out of bank deposits which pay close to 0%. This leaves the bank with less capital to use to loan to other businesses.

It’s also causing a compression of most bank’s profit margins. A bank makes less money if one of their clients moves from a cash account paying 0% to one of their money market funds paying 4%.

You can see investors in bank stocks realize the true impact of higher rates on a bank’s profitability. Below is one of the biggest ETFs consisting of U.S. regional banks (iShares U.S. Regional Banks: IAT).

2) U.S. Government’s Borrowing Costs Go Up

Higher interest rates are increasing the U.S. government’s interest expense as investors flock to the higher yields. This puts a strain on the U.S. government’s ability to spend on social programs as its tax revenue has to pay off its bondholders.

3) An Explosion in Unrealized Losses

Third, it’s also putting downward pressure on existing bonds.

An investor wanting to sell their old bond yielding 2% would need to sell at a discount in order to compensate the buyer for buying that bond versus buying one at 4%.

Banks hold their bonds to maturity. They don’t have to sell their bonds unless there’s an emergency — like SVB (if you want a refresher, we wrote about Silicon Valley Bank which you can read here).

This is called “mark-to-market.” It’s what the bonds would sell for if they had to sell.

Thanks to our 14-year, zero interest-rate (ZIRP) world, banks bought trillions of bonds yielding 0-3%. Those bonds are worth a whole lot less in today’s world.

According to the chair of the Federal Deposit Insurance Corporation (FDIC), there were $620 billion of such unrealized (or paper) losses sitting on U.S. bank balance sheets in early March.

Some experts quoted the losses could be as much as $1.7 trillion.

In the event banks, pension funds, endowments, or whoever has to sell… they’re taking significant losses.

4) Further Compression On Most Other Asset Classes

U.S. investors are finally getting a yield in safe(r) instruments like money market funds and bonds. The flight to these assets is understandable.

This is a good thing… as it’s a huge boon to retirees who don’t need to risk their savings in riskier assets.

But that means that same dollar isn’t flowing into equities, private equity, real estate, and the like.

We’ve already seen the asset carnage in equities and private equity last year.

It doesn’t seem like we’ve seen much impact on commercial real estate… yet. Which is one of the most, if not the most, levered asset class in the world.

Rates being higher means refinancing rates are higher, too.

What’s the value of an office skyscraper with an exponentially higher refinancing cost? How much is it really worth if occupancy rate is now 50%, due to the work-from-home trend?

We’ve already seen Blackstone limit withdrawals on multiple occasions from one of its biggest real estate investment trusts (REIT). Blackstone’s REIT was touted as one of the most liquid real estate funds in the world. Turns out it’s been anything but.

Conclusion

What does this all mean?

Money is flowing where it’s treated best — cash and money market funds.

Investors and savers finally have a place to park their cash and earn a decent yield.

But there are side effects with the amount of money flowing from one asset into another.

We’ve seen the ripple effects bubble up to the surface.

Most speculative assets are down.

However, we have yet to see the impacts on some of the “safer” assets — like real estate and older bonds.

That is something we’ll have to continue to wait and see. Be careful out there.

Good investing,

Lance