Sorry… there’s no such thing.

Investing isn’t easy.

Everyone would be wealthy if it were.

But that’s not what many financial pundits would have you believe — whether it be in the mainstream media, financial publishing industry, or financial Twitter (FinTwit).

Here’s an example:

How is this account so confident?

What does “no brainer” even mean?

Does it mean they’ll gain more market share in their industries? Or simply that these companies will be around in 10 years?

Is the prediction they’ll double? Go up 5x from here? 10x?

We know tomorrow is unknowable. In fact, it was only in the last 500-600 years that we, as humans, were even able to think far into the future.

We also know economic “experts” have an absolutely awful track record at predicting recessions. Here’s Bloomberg (emphasis added):

“In February, Andrew Brigden, chief economist at London-based Fathom Consulting, worked out that of 469 downturns since 1988, the International Monetary Fund had predicted only four by the spring of the preceding year. By the spring of the year in which the downturn occurred, the IMF was projecting 111 slumps, fewer than a quarter of those that actually happened. In a post on his firm’s website, Brigden wrote that while IMF economists monitoring Equatorial Guinea, Papua New Guinea, and Nauru can walk tall for their recession calls, the rest pretty much flopped. “Since 1988 the IMF has never forecast a developed economy recession with a lead of anything more than a few months,” he says.

IMF economists point out that they’re not alone in missing downturns. A recent working paper by Zidong An, Joao Tovar Jalles, and Prakash Loungani discovered that of 153 recessions in 63 countries from 1992 to 2014, only five were predicted by a consensus of private-sector economists in April of the preceding year. And the economists tended to underestimate the magnitude of the slump until the year was almost over.”

So what makes this Twitter account so sure that these three companies are “no brainers” 10 years from now?

Of course, “no brainer” wasn’t defined… which makes it easy for this account to move the goal post to his 20,000 followers over time.

We don’t mean to pick on this account. Rather the prediction business is all about one thing: making money.

Investing success comes from having humility. Without humility, you’re being intellectually dishonest to yourself.

But that’s not what sells ads or subscriptions.

There have been many studies that show how to outperform the market. Many we’ve written about.

We also know great products don’t always make great investments.

But if we’re talking about the next decade’s “no brainer” investments… then it’s all about the price you pay.

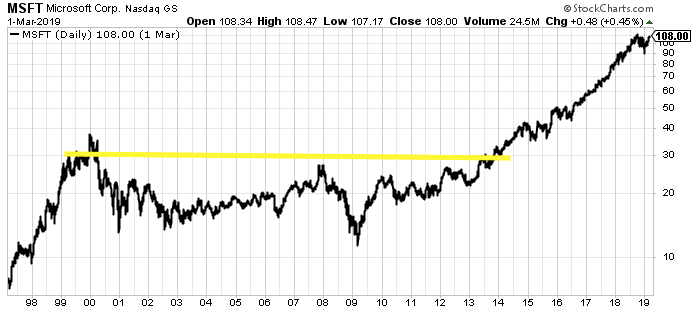

Take Microsoft, for example.

Microsoft is — and has been — a dominant company for the last 30 years. However, Microsoft was dead money for 15 years for any investors who bought during the tech bubble in the late 90s.

Oracle — another blue chip — was also “dead money” for 15 years.

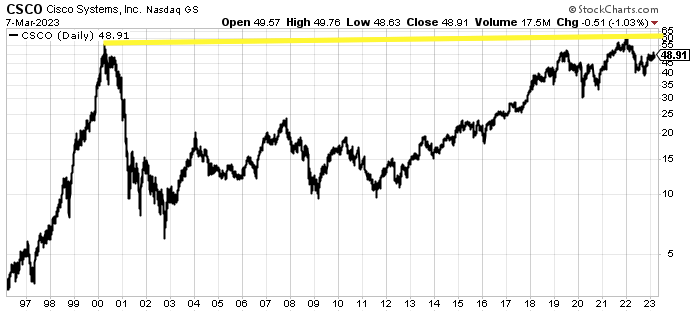

Even blue-chip company, Cisco, has yet to make it back to its all-time highs 24 years later.

If you’re making a 10-year bet… price matters.

So what exactly is this investor expecting for the next 10 years?

Let’s just say they’re looking to double their money with Tesla — one of their “no brainer” stocks.

Doubling your money over 10 years comes out to just over a 7% compounded annual growth rate — less than the market’s historical average.

So you’re better off investing in index funds.

But if the prediction is 5x — that means they’re predicting Tesla will become a $3.25 trillion company in 10 years.

Only a handful of companies have eclipsed $1 trillion in market cap (including Tesla). Apple is the only company to have eclipsed $3 trillion. But that was during the pandemic mania of 2020 - early 2022.

Is it really a “no brainer” on Tesla? That it will become the most valuable company in the world, eclipsing a market cap that has never been reached before?

Said differently: Is it a no brainer to bet on something that has literally never happened in history?

We’re not saying it’s impossible. But we’ll take the other side of that bet.

You’ll hear predictions everywhere. Mainstream media. Social media. Hedge fund managers. Friends.

Everyone’s got one. Exercise caution when anyone tells you an investment is a “no brainer”… let alone a generic prediction that’s going out 10+ years.

Good investing,

Lance