We’re sure most of you are trying to figure out what to do with your portfolio today.

The S&P500 is down approximately 11% from its peak. The Nasdaq is down approximately 20%.

Most tech stocks are down 50-80%+ from their all-time highs.

Tech giants, Facebook and Netflix, were taken behind the barn and shot – both down approximately 52% and 70% from their highs.

Bonds haven’t been a place to hide either. 2022 continues to break records — Not in a good way.

Jim Bianco from Bianco Research shows how devastating bond performances have been:

Volatility is here to stay. We’ve been warning clients and longtime Mighty readers since November. Here’s what we said in our November 2021 missive titled Don’t Fall For This Trap:

“Everyone’s getting rich right now.

Everyone’s got cash ready to spend and invest.

Every asset is at or near all-time highs.

Stocks. Bonds. Crypto. Real Estate. Art. New and Used Cars. Watches. Collectibles.

My guess is you’ve heard or read about some average Joe making millions, by getting lucky. Or maybe your friends and family are telling you how much money they’re making from some stock or cryptocurrency…

This is what happens towards the end of a bull market. The mania phase.

It’s probably making you want to dabble in certain asset classes you wouldn’t have ever gotten into…

Mania phases like these suck you in like a blackhole. Making you want to invest more and more of your money into speculative ideas.

Don’t succumb to the temptation.

Times like these are not normal. Getting caught up in this market will slaughter the average investor.

When the mania will end is anyone’s guess. And you won’t get a prediction out of me.

I just know the music will stop eventually. I don’t want you or anyone you know being the one left holding the bag when things turn.

Investing isn't about keeping up with the Joneses. It's about making sure you have enough money to live the life you want, when you want.

So make sure you don't fall for the ‘investing is easy’ trap from the mania phase that we're in.”

We echoed similar sentiment in our December 7th missive titled, How The Market Is Really Performing:

“Individual investors are withstanding a lot of pain right now.

But the markets don’t care about our feelings.

So the worst decision investors can make is trying to catch the falling knife.

That saying didn’t come out of nowhere. Many investors’ hands have been bloodied trying to pick the bottom.

No one can do it consistently. It’s a fool’s errand.

The knife is still falling. The market has a funny way of making sure that the majority of people suffer the most amount of pain.

Yes, you can put a small amount of cash to work. But it’s best to wait for the dust to settle. That hasn't happened yet.

Be patient. The time will come. Let the game come to you.”

Again in our January 11th missive titled Get Your Shopping List Ready:

“I hate making predictions… but I don’t think it’s time to buy just yet.

The knife is still falling. And the chart technicals in which market traders use to buy/sell are ugly.

I also don’t think we’re at peak negative sentiment, yet either. CNBC’s Fear & Greed Index shows a neutral reading. Meaning investors are holding… and not running for the hills.”

Again in February. And again in March.

Warning notes have been our tune for six months now.

The number of times we’ve told our clients and readers to “be careful” may have similar vibes to the boy who cried wolf.

We’ve de-risked some of our Disruptors. Raised cash. Added energy exposure. And increased exposure into our Trophy stocks.

But our portfolio is skewed towards the Disruptors – high growth companies. So our drawdown has made our clients nervous. And given clients pause as “what do we do now?”

Inflation. War. Geopolitical tensions. Elections. Recessions.

There’s always something to worry about. There’s always something that makes us want to hide in the bunker.

And yet, long term, the market rises.

The old adage at my former financial publishing firm was “the world has a way of not ending.”

It means you should be invested no matter what.

Where the market goes from here is anybody’s guess. That’s what makes a market. But the warning signals continue to skew the probabilities to the downside in our opinion.

Apple, Microsoft, Amazon, Tesla, and Google make up the top 5. They’re the five most valuable companies. And they make up about half of the entire Nasdaq Composite's value.

The S&P500 is in the same boat. They make up more than 22% of the index’s value.

And have contributed 51% of the S&P 500 returns since April. How these five companies perform will pretty much tell you how the entire market performs.

The technical charts on those “Generals” besides Apple and Tesla look horrible.

Here’s Microsoft:

Here’s Google:

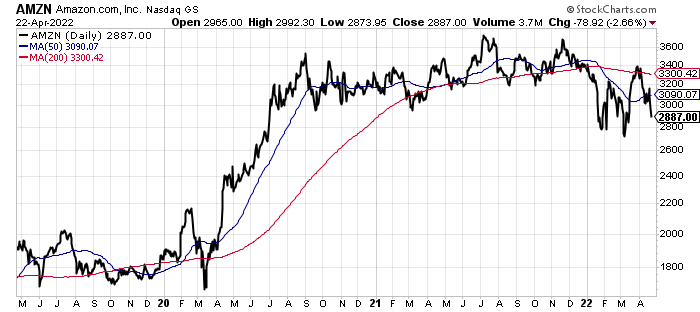

Here’s Amazon:

They’re rolling over in front of our eyes… making lower highs and lower lows… right as we’re entering earnings season.

It’s not pretty.

Meanwhile, the CNN Fear & Greed Index shows Fear - sitting at a level of 40/100. But we’re nowhere near extreme fear.

Financial Twitter (FinTwit) is still buying the dip.

Which leads us back to the question of what to do with your portfolio.

The answer has to do with how well you’re sleeping at night.

Would you panic if your portfolio dropped another 30%? If so, you’re overexposed.

It doesn’t matter if you’re sitting on losses in some of your positions… It’s not too late. You just admitted you can’t withstand more pullback psychologically. (Don’t worry, 99% of us can’t either.)

If the rest of these Generals get shot, you can guarantee the rest of tech will get slaughtered. (Yes, they can go down further. Remember, a stock that falls 90% first, falls 80%… then it gets cut in half).

Irrational selling or not. This is the market we’re in. You have to adapt to the market. It won’t adapt to you.

That’s where having an allocation to cash may help you sleep well at night. Capital now allows you to weather the storm. It’s purely psychological.

Because, truth is, you can’t time the market. Even if you can predict what’s going to happen, you can’t predict the real probabilities. Or the second or third order consequences. (Think: The markets booming because of COVID in 2020.)

Historical data suggests you shouldn’t touch your portfolio. Interrupting the effects of compounding crushes your long-term returns. So doing nothing is often the best move. Meaning stop looking at your stock performance everyday and potentially doing something stupid (i.e. selling).

But you need to do what’s best for you.

Anything to control your emotional level during times of high volatility. If that means raising cash and reducing your potential future returns. So be it.

Whatever you need to do to sleep well at night.

Good investing,

Lance

P.S. The Mighty Portfolio is built on three pillars: Disruptors, Trophy Assets, and Income/Hedges.

A three-legged stool can’t stand without all three legs. Take one out, and the stool falls.

These three pillars give us the ability to extend our time horizon for years... whereas the holding period of the average investor is eight months

If you’re interested in becoming a Mighty client, drop us a note at [email protected]!

Disclaimer: Mighty Invest LLC (“Mighty”) is an SEC registered investment adviser. Brokerage services are provided to Mighty Clients by Velox Clearing, an SEC registered broker-dealer and member FINRA/SIPC. Clients are encouraged to compare the account statements received from the qualified custodian to the reports provided by Mighty Invest. This should not be considered an offer, solicitation of an offer, or advice to buy or sell securities. Please note that to ensure regulatory compliance and for the protection of our investors and business, we may monitor and read e-mails sent to and from our servers. If you are not an intended recipient or an authorized agent of an intended recipient, you are hereby notified that any dissemination, distribution or copying of the information contained in or transmitted with this e-mail is unauthorized and strictly prohibited. Past performance is no guarantee of future results. The research is based on current public information that Mighty Invest considers reliable, but Mighty Invest does not represent that the research or the report is accurate or complete, and it should not be relied on as such. The views and opinions expressed in this are current as of the date of this email and are subject to change. The information provided is historical and is not a guide to future performance. Investors should be aware that a loss of investment is possible. The securities identified do not represent all of the securities purchased, sold, or recommended for clients. It should not be assumed that investments made in the future will be profitable or will equal the performance of the securities referenced. Additional information, including (i) the calculation methodology; and (ii) a list showing the contribution of each holding to the portfolio’s performance during the time period will be provided upon request. The information transmitted is intended only for the person or entity to which it is addressed and may contain confidential or proprietary material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender and delete the material from all computers. The sender does not accept liability for any errors or omissions in the contents of this message which arise as a result of this email transmission.