Many investors seem to forget… investing isn’t always sexy.

The moonshot investments that 10x in a couple of years are what get you on the front page. They’re what’s appealing to most investors.

But many of the legendary investors you likely know of became famous because they did… nothing.

Hence Warren Buffett’s ideal holding period of “forever.”

Boring wins over the long term. Inactivity wins over the long term.

Crushing The Market Selling Burgers

Take McDonald’s, for example.

Selling burgers for 30 years doesn’t make you the center of attention at a cocktail party.

Yet McDonald’s has outperformed the S&P 500 by over 3% per year since the S&P 500 ETF (SPY) was created. (Source: David Bahnsen’s, founder, managing partner, and chief investment officer of The Bahnsen Group pulled from Thoughts From The Frontline.)

Amazingly, the current $5.52 annual dividend was where McDonald’s was trading at 30 years ago.

Meaning if you bought McDonald’s 30 years ago and held… you’d be earning a 100% cash-on-cash yield on your original purchase price.

Who wouldn’t be happy with a 100% cash-on-cash yield on any investment? And that’s not including McDonald’s 55x+ return over the past 30 years.

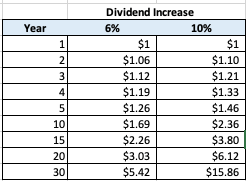

(Note that McDonald’s raised its dividend by about 6% per year over 30 years.)

At Mighty, we’re trying to somewhat replicate this playbook: Buying Trophy Asset companies. But with a little bit of faster dividend growth.

Several of the Trophy Asset companies we hold are increasing their dividends 10-20% per year.

Here’s what that math looks like over 30 years:

We’re Hunting For Trophy Assets Like McDonald’s

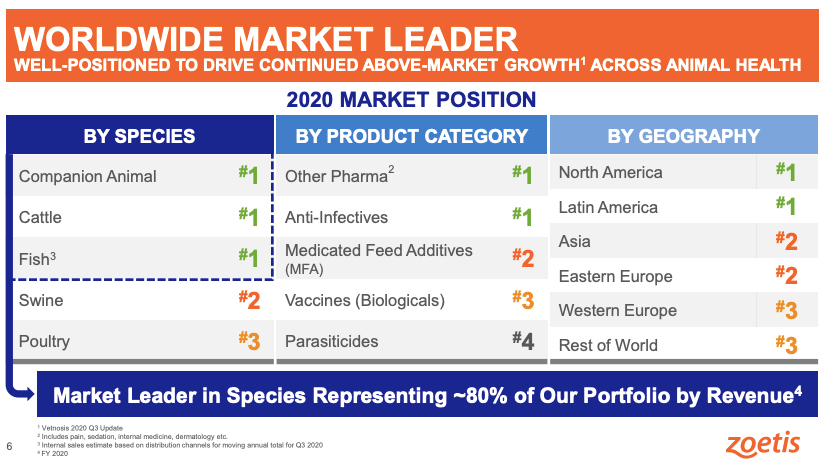

One of our Trophy Asset holdings in the Mighty Flagship Portfolio is Zoetis.

Zoetis is the largest animal health services company. They have over 300 product lines and 8 blockbuster products — ones which make over $100 million in annual revenue.

It owns top 3 market share in pretty much every category it operates in.

Look up and down its financial statements and you’ll see Zoetis is a profit machine.

Gross profit margins are 70%. Net profit margins 25%+. Returns on equity (ROE) are 50%+. We could go on.

But the best part is how shareholder-friendly Zoetis is.

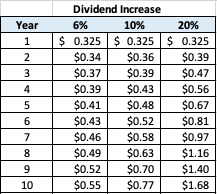

Zoetis has increased their dividend by about 20% per year since it went public in 2013.

That includes their most recent 30% dividend increase in the beginning of this year.

We don’t see any signs of that slowing down.

Zoetis’s payout ratio is just 38%. Meaning Zoetis pays out just $0.38 of every dollar it generates in profit after all expenses are paid. It has significant room to scale the dividend.

If Zoetis raises its dividend by 20% each year for the next 10… we’ll have a 4% yield on today’s prices. And that’s without any capital gains assumptions.

You can see the power of compounding at 20% versus 6%. Or even 10%.

Zoetis would pay a quarterly dividend of $0.77 at 10% growth. But would pay a $1.68 quarterly dividend in year 10 at 20% growth — a 118% difference.

Take it out 30 years and you’ll be blown away.

That’s the beauty of compounding. (Although we’re not suggesting nor implying Zoetis will grow its dividend by 20% for 30 years straight.)

That is why we plan on holding Zoetis for the long term. They are the dominant player in their space. And they’re shareholder-friendly. The exact definition of a Trophy Asset.

We have several other companies within our Trophy Asset pillar that are growing their dividends by double digits annually… with plenty of room to spare.

We expect these companies to be in our portfolio for years to come. Assuming they continue to increase their dividends like years past, we’ll be earning high dividend yields over the long term.

But our Trophy Asset companies aren’t ones to make front page news every day. Their businesses don’t capture investors’ wildest imaginations — Ones that could 10x in a couple of years.

Investors would rather go for the moonshots. Just like they’d rather put it all on red or black at the roulette table.

Our Trophy Asset companies are plain vanilla. Great businesses that dominate their industries and gush cash. Then successfully return that cash back to us shareholders.

Just like McDonald’s. Who would’ve thought selling hamburgers would return 55x over 30 years and eventually have a 100% cash-on-cash yield? Not many.

Yet we expect to earn high rates of return and high dividend yields over the long term with our Trophy Assets.

The only thing we have to do is… nothing.

We suggest you do the same with your respective Trophy Assets.

Good investing,

Lance