“Why are we paying you to hold our assets in cash?” The limited partner asked their hedge fund manager.

The hedge fund manager immediately responded, “You’re not. You’re paying me to know when to hold your assets in cash.”

This story represents a powerful lesson. One which most individual investors have a hard time wrapping their heads around:

Cash is a position.

Cash gives you the ability to sleep well at night — especially during bear markets. It’s a hedge against volatility. And it’s an option on future opportunities. That’s why cash is king.

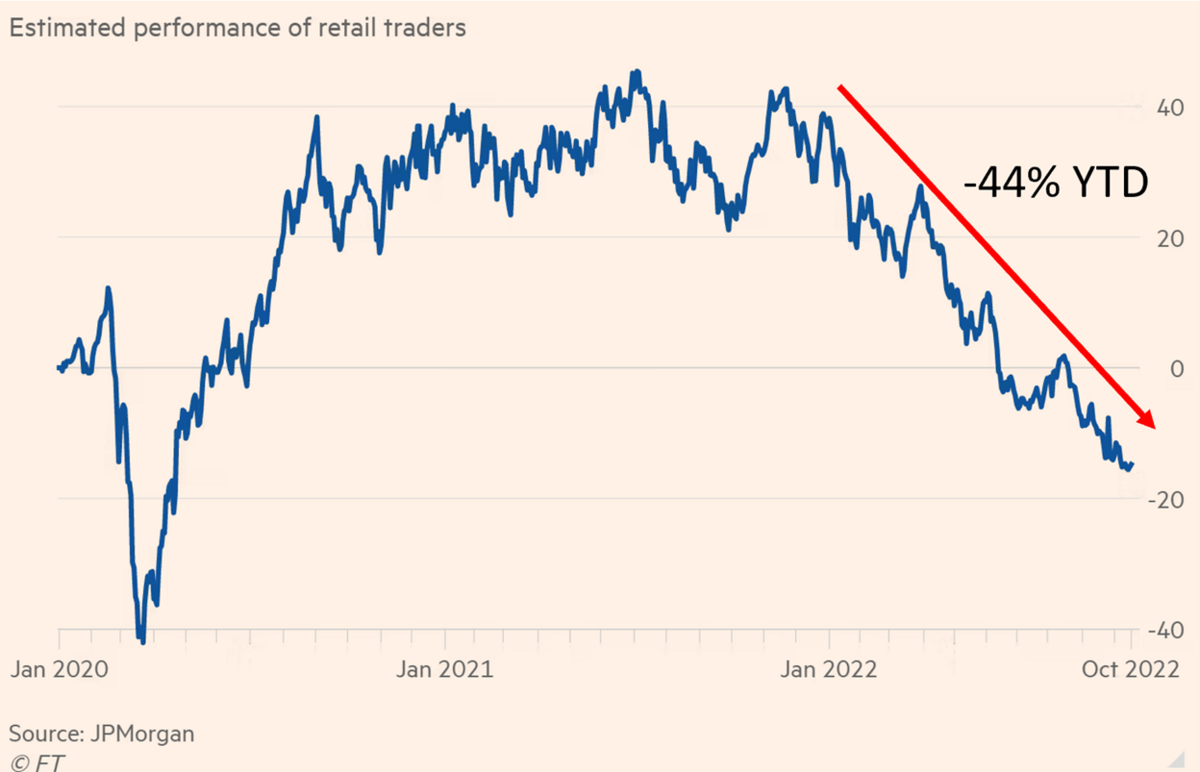

The average retail investor has gotten crushed this year. (Our guess is most have been fully invested this whole time.)

“According to JPMorgan Chase (JPM), personal portfolios in the U.S. fell a horrifying 44% between early January and October 18, as you can see in this chart.” (Source: Financial Times).

Even worse is Cathie Wood’s flagship ARK Innovation ETF (ARKK) — which we suspect many individual investors follow her advice and stocks.

ARKK is down 71.5% from its late 2021-peak:

Retail investors have plowed $1.8 billion into ARKK this year despite its horrid performance.

Our guess is retail continues to make the same investing mistakes over and over:

Overweight story stocks at the peak.

Being too slow to adjust portfolio allocation.

No diversification or position sizing.

Selling winners and doubling down on losers.

No stop loss or exit strategy.

Following mainstream media recommendations.

Fixing these mistakes doesn’t make investing easier. It just prevents severe permanent capital loss when times get tough.

That is the reason retail investors and Cathie Wood’s ETFs have been obliterated this year.

Another classic investing trap we heard over the past year was:

“I lose 8-10% of my money holding cash when inflation is running at 8-10%. I’ll stay fully invested.”

That hasn’t worked out well either.

The only solace for most retail investors is that the standard 60% bonds / 40% stocks (the “60/40”) portfolio is having its worst year-to-date returns in 100 years.

But not 71.5% ARKK bad. An actively managed portfolio should never see a drawdown of 3/4.

Investors need ARKK to rise more than 230% just to get back to breakeven.

That’s why knowing when to hold cash is so important.

Because knowing when “The Generals get shot,” when the Federal Reserve is hellbent on destroying as much of your wealth as possible, when the knife is falling, and when to hold enough cash in order to sleep well at night is important to weather this volatility.

We’ve been holding 30-40% cash since the beginning of the year. And that’s on top of our hedging positions too.

Our portfolio hasn’t been immune. We’ve taken our hits. We’re down about 20% this year versus -17% and -30% for the S&P 500 and Nasdaq. (We took most of our losses earlier in the year by selling down some losers and de-risking.)

However, our volatility is lower than the market. We’ve tactically clawed our way back with a strong trading track record (See here and here for examples.)

Most retail investors have been paralyzed by the volatility. They continue to make classic investment mistakes (see above.) And have seen their portfolios halve this year alone. Or watched their portfolios drop by 71.5% if they’ve put their money with Wood.

Our clients pay us to know when to hold cash. We’ve been building a cash position since November 2021. And plan on doing so until the knife stops falling. That’s been the right decision. One we’re proud to have made early on.

Ask your financial or wealth manager about how they think about cash as a position in this market. Do the same if you follow financial publications too. After all, they’re managing your money.

If they haven’t used cash at all to their advantage, then you may want to dig deeper. Or look elsewhere.

Mike and I are happy to help if you’re looking for some guidance. Our portfolio is based around Trophy Assets (see here and here) within our Three Pillared Portfolio.

If you’re interested in joining Mighty, just reply back and let’s set up a call.

Good investing,

Lance