Look, the market is right most of the time.

It’s punished Roku shareholders over the past year — down more than 80% from its highs.

We’re not immune. Roku is one of our largest weightings.

There are legitimate concerns for Roku. Any time you’re dependent on other companies (i.e. TV original equipment manufacturers — OEMs) for your growth, there’s risk.

Similarly, it’s quite nerve-racking when your primary competitors are Amazon, Google, and Samsung.

They’ve destroyed more businesses and shareholder value simply by looking in your industry’s direction.

But we think the long-term outlook for Roku is very bright. Especially at these levels. The margin of safety is higher than it’s ever been.

We think investors are acting a bit short-sighted in this market. But that’s normal. Data shows investors have a holding period of 8 months.

Add in the volatility we’ve seen in 2022… and it’s no wonder Roku is in the doghouse.

For this post, we’re going to run through the most common theses we think Roku bears are missing. This is just part one of two or three.

1) Who Needs A Roku Anymore? It’s Just A Dongle

Bears: Uh, Roku? That still exists? They’re just like Blackberry… first mover advantage. But now the big dogs — Amazon and Google — are involved. No chance they win.

This is the most common misconception.

Most of our friends and family had no idea that Roku was still around. Or that they sold more than just dongles.

We even saw some Wall St. analyst on CNBC earlier this year claim how Roku is a dying business… because no one needs a device to connect to their old, linear TV anymore.

Something similar to this:

We get it. It’s an issue.

Stock performance is narrative driven. Otherwise, they’re in the doghouse.

The narrative of the transition from linear TV to connected TV (CTV) is known. It’s not an undiscovered gem.

Meaning Roku doesn’t have much of a catalyst.

But the fact is, Roku IS the smart TV.

Roku’s operating system (OS) is in 1 of every 3 connected TVs (CTV) sold in the U.S. It’s in 1 of every 5 CTVs sold in Mexico. And has the #1 market share in Canada — showing its dominance in North America.

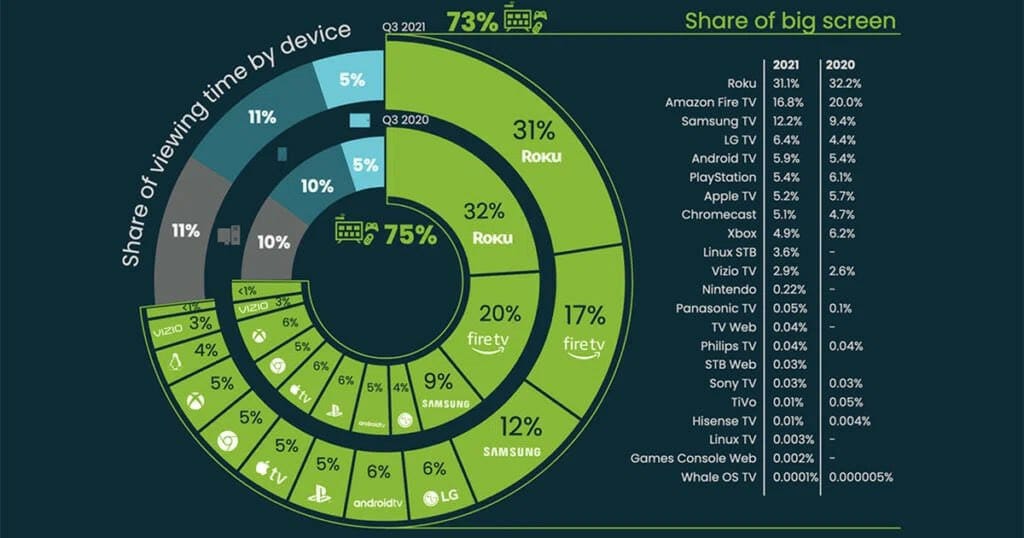

They’ve maintained the same 30%-33% global market share since the transition to CTVs began.

They make up 39% of the U.S. market share according to Nasdaq.com (as of Jan ‘22).

Lastly, TVs are inelastic purchases.

Most U.S. households buy new TVs roughly every five to eight years.

Phones are swapped every 2-3. Laptops, a little longer.

So Roku remains entrenched in the household for several years after the purchase. That provides huge downside protection to Roku’s user numbers as long as they maintain 33% market share.

2) User Growth Is Roku’s #1 KPI

Bears: Roku’s user growth is slowing. A sign the business is dying. No user growth = no one likes Roku.

The #1 key performance indicator (KPI) that investors in Roku should think about isn’t user account growth…

It’s their average revenue per user (ARPU).

But let’s take a step back.

Statista estimates more than 120 million American households own a TV.

According to Nielsen, there are an average of 2.5 televisions per household. And 31% of households have more than 4 television sets.

A report from Leitchtman Research Group estimates more than 80% of U.S. households with a TV have at least one “Internet-connected TV device.” That definition means either smart TVs, connected video game systems and Blu-ray players, as well as Internet streaming boxes and sticks.

Meaning the total addressable market (TAM) is anywhere from 300 million TVs to 480 million TVs for Roku.

That’s not insignificant. And that’s just in the U.S. alone.

But back to ARPU.

ARPU is what all platforms use to measure how effective they’re able to monetize their users. Here’s Roku’s ARPU growth since inception.

Roku’s ARPU in Q3 ‘16 was $9.26.

Today — Q1 ‘22 — it’s $42.91.

Roku has 4.6x’d ARPU in 5 1/2 years. A 32.15% compound annual growth rate (CAGR).

Roku’s year-over-year (yr/yr) ARPU growth is almost exactly inline with the CAGR — averaging nearly 35%.

So that’d be a solid baseline to make some assumptions into the future.

We get an ARPU of $74.15 if Roku can just achieve a 20% ARPU CAGR by Q1 ‘25.

Assuming Roku doesn’t add a single user from today, it’ll generate $4.5 billion in revenue ($74.15 ARPU x 61.3 million users for Q1 ‘22).

That’s just over a 2x enterprise value (EV) to price-to-sales (P/S) multiple on 2025 revenue.

We’d say that’s quite conservative.

Roku has generated $2.9 billion in revenue in the trailing twelve months (ttm).

Meaning today’s ttm P/S multiple stands at 3.6x.

Apply that same multiple to the $4.5 billion in estimated ‘25 revenue and we get an EV of $16.2 billion — a 15.5% CAGR from here.

Assume Roku compounds ARPU by its historical 32.15% and we get an ARPU just shy of $100.

Again assuming they don’t add a single user and Roku generates just over $6 billion in revenue. Slap today’s 3.6x EV/S multiple and we get a $21.6 billion EV — a 27.2% CAGR from here.

We wrote a similar thread back in February after it reported full year 2021 results.

That’s why we think ARPU is the real, true KPI you need to watch above all else.

Generate more revenue per user…. and your business becomes more valuable.

Oh, and here’s Roku’s user growth since they started reporting. We estimate Roku will end 2022 at 66 million users (we’re modeling just 10% growth over 2021 where their average is 35% annually. Also note they grew users by 17% in 2021 alone.)

Roku had 16.4 million users by the end of 2016. They have 61.3 million users today.

Meaning Roku’s user base has grown almost 4x in less than 6 years — a 27% CAGR.

Hardly a dying business. Which leads us to the next Roku bear thesis debunked.

3) Roku Will Struggle Growing Its ARPU

Bears: Okay, ARPU has grown nicely. But that’s backward looking. Their future is way more unknown. Advertisers would likely shift their ad dollars to competitors like Youtube. Or stick with linear TV.

The advertiser shift to CTV is still ongoing.

From Roku’s Q1 ‘22 Shareholder Letter:

Today in The U.S., Nielsen reports that audiences spend 46% of their TV time streaming, while eMarketer reports that advertisers spend just 18% of their TV ad budgets on streaming.

That’s up from around 4% in 2018 according to eMarketer.

So advertisers are starting to shift their budgets over. In an accelerated way too.

The north star for all advertisers is return on ad spend (ROAS) — the ability to generate revenue per advertising dollar spent.

Advertisers go to marketplaces where they can target their audience with the utmost specificity. It’s what makes Google and Facebook two of the biggest companies in the world. Their marketplaces attract billions of people. They collect thousands of data points on each person that uses its platform. And allow advertisers to hyper-target these individuals.

Traditional linear TV can’t do that to the same extent. It uses Nielsen data as a gauge of who’s watching and when. Cable channels have a broad idea of who their audience is. And a rough estimate of how many people watch a show, at what time.

So advertisers have to guesstimate when it’s the most appropriate time to schedule their ad: “Show my ad during the 8 p.m. hour on Friday night.”

It’s not that advertisers don’t generate a return on ad spend (ROAS) on these placements. They’re very effective in generating gross revenue dollars.

In fact, they’re still one of the most effective mediums… which is why they’re still a massive multi-billion dollar industry. CPMs are in the $20+ range.

But the issue is true, final attribution. Advertisers can’t fully attribute if/when their end customer purchased a product because of the ad.

Attribution is the lifeblood of every advertiser.

Example: How would Coke know you bought their soda after you saw their ad four days ago vs. yesterday? Or if you bought their soda when seeing their ad on one channel vs. another? Or if you bought their soda from their 3 p.m. ad slot vs. their 7 p.m. ad slot?

Advertisers need to know how to attribute their spending. It’s how they determine where to shift their ad dollars in the future.

Again, this is what makes Google and Facebook so effective. Attribution is done at the point of an ad click. Or email signup. Or sale.

The advertiser knows exactly when and where someone came from. And will shift their ad dollars accordingly.

Roku owns and collects all the data of its customers. They know if/when one of their users sees an ad (aka an impression). They can show a single ad impression to the individual viewer. This is the key differentiator with linear TV — the ad impression.

Their ads are becoming more interactive too. So they’ll collect data on when a user engages with the ad. (We’ll discuss this in depth in Part II).

Roku finally provides the attribution to advertisers. So they’re shifting their budgets accordingly.

Again from Roku’s Q1 ‘22 Shareholder Letter (emphasis added):

“In Q1 the top 10 broadcast TV advertisers increased spend on Roku nearly 80% year-over-year, while spending 7% less on legacy pay TV. This shift is being driven by our significant scale of more than 60 million Active Accounts, our first party data, and our integrated ad platform. Advertisers who partner with us are coming back and spending more: In Q1 we retained 96% of advertisers that spent $1M+ (calculated year-over-year on a trailing 4 quarter basis), and average spend among returning advertisers increased more than 50% year-over-year. Advertisers are also increasingly leveraging OneView®, our ad platform built for TV streaming, and our first party data for campaigns both on and off the Roku platform. The gap between ad dollars and viewership is starting to close, and eventually all TV advertising will be streamed.”

That’s the power of targeted advertising.

Roku can break out where you saw the ad: Its Homepage, The Roku Channel, a Streaming Service.

What type of ad — display or video. The size of the ad. How long the ad was. Exactly when it was shown. Etc…

The success of targeting will drive more advertisers to the platform.

Think about a company seeing their competitor’s success in driving successful CTV advertising. That will force the company to also spend on CTV ads.

Take Neutrogena, a Johnson & Johnson, skincare product, for example. Roku highlighted their success in their shareholder letter (emphasis added):

“The advanced targeting and measurement that only Roku can provide in TV streaming resulted in Roku users who saw the ad campaigns spending 4.2x more on Neutrogena towelettes than the average Kroger household.”

You think any of J&J’s competitors will let them take market share of this skincare line? Of course not.

This forces them to explore, test, and spend on CTV ads.

Thereby drive up the supply/demand function. Thereby drive up the cost to show their ads (CPM).

Higher CPMs = More $ for Roku.

However, CTV is still in its infancy stage. There’s a reason 18% of ad budgets are still fixed on linear. It’s because it’s easier for advertisers to reach a much wider audience.

The metaphor that comes to mind is:

Linear TV advertising takes a shotgun approach. CTV advertising is like a sniper.

A couple of ad agencies called out a couple valid points with the limitations of linear TV (emphasis added):

“Nonetheless, what those models are showing is that advertisers are surrendering some of TV’s efficiency as they move money to streaming, said a second agency executive. Advertisers may be exchanging TV’s broad reach for streaming’s more targeted options, but the streaming’s higher ad prices result in advertisers reaching fewer people for more money, which is an issue for brand advertisers aiming for broad audiences.”

“Marketing mix models “are not stupid. They’re catching up fast and saying we took a really efficient dollar [in TV] and made it inefficient [in streaming],” said the second agency executive.”

The cost of hyper-targeting is still expensive. Because you have to go super granular in order to reach your audience.

As more consumers shift to streaming, the more data points get collected. Which opens up supply and targeting efficiency. At scale this solves the above challenges of current advertising agencies.

5) Roku Will Lose King Of The Hill Status

Bears: Roku is inferior to Google and Amazon: First in terms of data. Second because of scale. They are fighting an uphill battle against these giants. No chance they win.

Yeah… that is true.

But let’s take a step back.

We already mentioned Roku powers 1/3 of every TV sold in the U.S.

People get used to their current TV’s interface. They become familiar. So chances are they’re going to find a similar TV to the one they had previously.

Roku’s interface is, in our opinion, second to none. We own multiple Roku devices in our house. We’ve anecdotally asked, heard, and seen similar feedback.

Also, Roku has a perfect 5-star rating on Amazon with over 150,000 reviews.

So even though Roku doesn’t have the size or scale of Google or Amazon…. It has a loyal customer base. One that churns infrequently. And has the best UI/UX.

Therefore, we don’t think Roku needs to “win” the entire market.

Roku CEO Anthony Wood doesn’t either. He’s answered this question many times before. But here’s Wood again during the Q1 ‘22 earnings call:

“So I think if you just -- in terms of why is it going to continue to consolidate, it's because the amount of money that goes into building a competitive TV streaming platform is very large and growing. I mean we're funneling all a big chunk of our gross profit back into building the strength of our platform. It's very hard for -- certainly for a new player. Like it's hard for you to imagine how they're going to be successful given the long number of years that we've invested in our platform and our competitors have as well.

But also just you have to amortize that cost across a larger and larger installed base to be competitive. Scale is super important. So it's the exact same phenomenon. I mean in PCs, there used to be lots of different PC operating systems. In phones, there used to be lots of different phone software stacks. Now there's only a couple. The same thing is happening in TVs.”

I think Wood hits the nail on the head. And this is where we think Roku bears continue to get it wrong.

Bears think there’s only ever one winner in markets.

Yes, Amazon has by far the largest market share in e-commerce — at 40%+. Its lead as king of the hill is wide.

But Shopify, WooCommerce, and BigCommerce alone still have $60+ billion worth of collective market cap. (Shopify makes up 90% of the 3 players market cap.)

And those are just the small players.

There’s Etsy and Pinterest.

And then there’s Walmart, Target, eBay, BestBuy, etc…

Meaning the TAM is big enough for many players. And it’s still growing.

Apple’s market cap is $2-3 trillion. But Google’s Android phones still make up more than 3/4ths of the cell phone market share.

Beside Google and Apple, cell phone makers themselves — LG, Samsung, Motorola, Nokia, etc… — are all multi-billion dollar companies.

Most markets are duopolies or oligopolies. Gaming consoles. Ride sharing. Food delivery. Internet providers. Social media platforms. Railroads. Airlines. Etc…

The point being, Roku doesn’t have to win.

They just have to be a top 2-3 player in the CTV market to sport a much higher valuation from here in the future.

Good investing,

Lance

P.S. We’ll continue Roku’s Bear Thesis Part II soon.

In it, we’ll cover:

Why Netflix Getting Into a Free, Ad-Tiered Service Is A Positive

What Bears Are Missing Behind Roku’s Untapped Market

Why Roku’s Content Push Isn’t To Compete Against The Likes Of Netflix & The Rest

Why Roku’s Supply Chain Problems Are Solvable

Subscribe below to get our weekly email. Plus Roku’s Bear Thesis Part II.