We’re continuing our Roku Bear Thesis Part II.

If you haven’t read Part I, click here.

For those who are reading this section before Part I, we’re taking every bear thesis and breaking them down.

The idea being we’re showing that Roku isn’t some dying business. Rather the margin of safety from these levels are high. And the upside from buying at today’s prices presents high returns on our capital.

Let’s get to it:

6) Netflix Launching An Ad-Supported Product Is A Negative For Roku

Bears: Okay. Roku rode the coattails of Netflix growth. Netflix exploring a free, ad-supported version is a direct assault on Roku. Especially to The Roku Channel.

We think this is a valid argument. But we think bears are missing the second and third order effects as a result of this.

But for those who don’t remember, Netflix lost subscribers — 200,000 subscribers —for the first time in over a decade this past quarter (Q1 ‘22). They lost 35% of their market cap in a day. Equal to about $50 billion.

The earnings call was a disaster. Netflix management seemed baffled. Their projections going into the year didn’t expect this at all. And the call was all about figuring out what to do next.

What was once considered taboo for years — offering an ad-supported service — is now back on the table.

Yes, removing password sharing will unlock a huge amount of revenue… but, in our opinion, the decline in subscriber growth will, by far, outweigh the net revenue collected.

Netflix knows this. And is trying to find the best way to roll out single-user accounts without seeing a massive churn.

In a survey from last year, equity research firm Cowen (COWN) found that 45% of respondents shared a Netflix password with family, friends, or roommates. That number has remained steady between 41% and 55% in monthly surveys conducted over the past five years.

Here’s Netflix Chief Operating & Product Officer Greg Peters on the Q1 ‘22 earnings call (emphasis added):

“It's important to note that we're trying to find a balanced approach here, and we're trying to basically come up with a model that supports a customer-centric approach. It still puts members in charge, it supports member choice, that delivers great entertainment value and sort of all of the options that we've got. But also, very importantly, allows us to bring in revenue for everyone who's viewing and who gets value from the entertainment that we're offering. And then obviously, we're doing that so that we can invest then into more great content and a better service for everyone.

So there's a bunch of factors that we're working through. That's why we've deployed the test that we have. And frankly, we've been working on this for about almost 2 years. We -- about a year -- a little bit over a year ago, we started doing some light test launches that we -- informed our thinking and helped us build the mechanisms that we're deploying now.

We just did the first big country test. But it will take a while to work this out and to get that balance right. And so just to set your expectations, my belief is that we're going to go through a year or so of iterating and then deploying all of that so that we get that, sort of that solution globally launched, including markets like the United States.”

The U.S. is their most penetrated market. One where Netflix charges the most and has the highest average revenue per user (ARPU). They charge $15/month.

(Longtime Mighty readers and clients know our whole Roku thesis revolves around their ARPU growth. You can re-read why in Part I here.)

There’s your proof. Netflix is at least a year away from rolling out their password-sharing removal test. Which means its streaming competitors — HBO Max, Apple TV, Disney+, Peacock, Showtime, etc… — have another year’s worth of content production to level the playing field.

Netflix’s moat is not as strong as it used to be. It’s forcing them to explore the ad-supported tier because the market won’t fund Netflix’s content production with free money anymore.

Regardless, the real bear thesis is: How does Netflix’s ad-supported tier benefit Roku?

The answer plays into Roku’s whole model of licensing content. Specifically to The Roku Channel.

Content producers have a massive churn problem.

From the Wall Street Journal:

“Roughly half of U.S. viewers who signed up within three days of the release of “Hamilton,” “Wonder Woman 1984” and “Greyhound” were gone within six months, Antenna data show…

Streaming services spent about twice as much on content—both to create originals and acquire the rights to old movies and shows—last year than they did in 2017, according to projections from Ampere Analysis, a research firm.”

Similarly, about 1/4 of all air time, all advertising time, is used to cross-promote shows.

Lastly, viewers hardly ever rewatch shows or movies.

Anyone rewatch Bird Box? How about Murder Mystery?

Truth is, the vast majority of shows and movies never get rewatched. So there’s tens of billions of investment into content that effectively has one-time use.

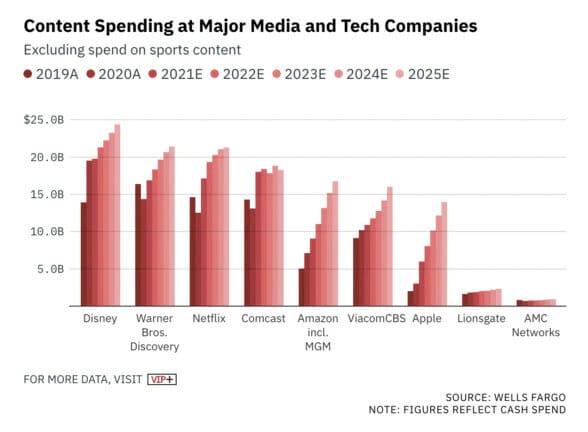

Streaming platforms are on pace to spend more than $100 billion per year on new content.

Yes, it’s great for these streaming platforms to offer subscribers their massive library. But why not try and leverage it to gain new subscribers?

That’s where Roku comes in.

Where will streaming providers like Netflix go to try and license their content?

Why not license season 1 of Ozark or Bridgerton or You or whatever onto The Roku Channel in an effort to upsell their services with a click of a button?

Why not let Roku promote Bird Box or Extraction or any of its original movies to its audience?

After all, Netflix needs a new revenue stream to fund its production spending.

Maybe they’ll keep their top tier content on Netflix. But how about the hundreds of shows and movies Netflix produced that no one’s ever heard of?

Yes, Netflix will do the same thing through their own ad-supported tier. But Roku (and The Trade Desk) are going to be the ones powering those ads.

Here’s Netflix Founder and CEO Reed Hastings on the Q1 ‘22 call (emphasis added):

“In terms of the profit potential, definitely, the online ad market has advanced. And now, you don't have to incorporate all the information about people that you used to. So we can be a straight publisher and have other people do all of the fancy ad-matching and integrate all the data about people. So we can stay out of that and really be focused on our members creating that great experience and then again, getting monetized in a first-class way by a range of different companies who offer that service.”

Both things will happen.

Both are win-win’s for Roku and Netflix.

Because the truth is, most people prefer a free, ad-supported tier.

Netflix will license their old content to Roku for hundreds of millions of dollars. Money that’s no longer “free” from outside capital (at zero percent interest rates).

Roku then gets more content onto The Roku Channel.

Netflix will launch an ad-supported tier model. And Roku will power the ads.

Roku CEO Anthony Wood opined on the Netflix situation in Roku’s Q1 ‘22 call:

“Roku is a streaming platform, which is a different business model than an individual streaming service. And sometimes people confuse the two. But our business model and the way we make money is to connect consumers with content and with advertisers. And so anything that causes more streaming to flow through the Roku platform is good for us and good for our business. More generally, I think we believe that more ad supported video on demand (AVOD) offerings will accelerate the movement of traditional TV budgets into streaming.”

We agree with Wood.

Netflix moving in this direction is a net win for Roku.

7) Roku Investing In Original Content Is A Waste Of Money

Bears: Roku is supposed to be a walled garden. Getting into the content game is a losing battle. A money pit, too. It shouldn’t spend any money on original content.

We’d agree with bears here… if Roku was actually going all-in on the content game.

But they’re not.

Let’s take a step back for a second.

Some people may require the spectacular disaster that was Quibi.

In 2018, Jeffrey Katzenberg and Meg Whitman raised $1.75 billion to launch Quibi — a new streaming platform focused on short sub-10 minute episodes.

Katzenberg is a well-known media producer and former chairman of Disney. Whitman was president and CEO of Hewlett-Packard.

They blew through that $1.75 billion in about two years — or about $2.2 million per day. Quibi shut down just six months after launch.

Quibi didn’t work because six-to-ten minute episodes didn’t/couldn’t stand alone. But they work for Roku.

Roku picked up the majority of Quibi’s films for $100 million. Roku literally bought Quibi’s content for $0.06 on the dollar. They renamed them Roku Originals.

And you know what? Quibi content blew it out of the water on The Roku Channel (TRC).

They launched 30 Roku Originals content in Q2 ‘21 on TRC.

From May 20-June 3 2021:

• A record number of unique accounts streamed The Roku Channel

• The top ten watched programs on The Roku Channel were all Roku Originals

• More than 1 in 3 users of The Roku Channel streamed a Roku Original

TRC has remained a top 5 streaming app on Roku since.

However, bears would concede Quibi content was a success. But likely a one-hit wonder.

Roku had so much success, they just announced they’re exploring a bid to try and buy 20% of Starz and get access to a bunch more “original” content.

Lionsgate acquired Starz for $4.4 billion in 2016. But hasn’t made anything of it. Starz has struggled. It’s now valued at around $3 billion. But we think it won’t fetch anywhere near that price. Which is why Roku is negotiating for a better price.

They’re literally replicating the Quibi playbook.

Maybe the bears concede the Quibi/potential-Starz playbook is fine. But actually spending on original content is a losers-game.

It’s true. Roku is, in fact, spending money to produce their own films. They will spend around $1 billion on content in 2022.

The return on investment here is to be determined. Likely negative.

But there is some precedent.

They acquired Zoey’s Extraordinary Playlist. Created an original Christmas special of it titled, Zoey’s Extraordinary Christmas, and it ended up being the No. 1 on-demand title on The Roku Channel by reach in Q4 ‘21.

Roku has and collects all the data on what its viewers are watching.

As it explores self-produced “originals,” Roku knows what to double down on and what to cut bait on.

All this content is effectively just a data capture for future advertisement placements. Similar to Google and Facebook.

Roku sees the data on what its users are watching… and then knows what content to produce in the future. Or what content to buy for pennies on the dollar.

These original content titles continue to build demographics on who Roku’s users are… to then connect them with targeted advertisements.

That is the end game. The gold mine of data for advertisers.

From Roku’s Q3 ‘21 Shareholder Letter:

“Half of the top ten on-demand titles by reach on The Roku Channel last year were Roku Originals. Our robust content offering and our unique ability to efficiently and effectively promote content to our users creates significant value for advertisers. On average, 91% of adults aged 18-49 that advertisers reached on The Roku Channel had not seen these ads on legacy TV.”

And all the content Roku licenses — including, what we think will eventually be Netflix content — gives them an inside look into what content those streaming platforms use.

Netflix, Disney+, Apple TV, Xfinity, and the like don’t publicize the demographics of who’s watching their content. They only share total reach.

All the content they license to Roku gives Roku the ability to build that same data set and heuristics. Something the streaming platforms can’t do for each other. Roku can then use that knowledge to dictate what type of content Roku users are likely to engage in.

This is how we think Roku will increase the probability of a higher return on investment on its original content spend. It’s purely data driven. Not just blanket content spending like the rest of the industry.

Here’s Roku CFO Steve Louden during Needham’s Annual Virtual Conference on May 16th (emphasis added):

“A good example would be This Old House, right? We bought This Old House, a great franchise, and so we've been able to upsize the number of episodes that we're producing on This Old House. We've started some linear channels, both a free linear channel within Roku -- The Roku Channel as well as a subscription channel within the premium subscription side of The Roku Channel. And so we've been able and drive a lot more engagement to that property…”

“…We have a lot of data on what categories do well, how much engagement. This Old House or other things on that, we can look at comparable shows, right, and see kind of, roughly, the engagement. And so we do our own business modeling, not only for licensing, but also for potentially Roku Originals or acquisition of content so that it works in that model.”

“But we have increasing amounts of data, both longitudinally as well as the amount of engagement we have and the breadth of content. So we leverage that. And that's one of the important advantages of being the platform, right? We have the first-party relationship with the consumers. That's really important for relevant content, to feed them in the UI and also to monetize on a targeted basis. But it's also really helpful for understanding what areas of content are good investments.”

Roku’s decisions are all data driven. It’s not looking to get into the arms race. Original content has worked. And they will use it to accelerate the flywheel.

8) The Roku Channel Will Never Be Able To Compete With The Industry

Bears: The Roku Channel (TRC) is a useless, non value add channel/service. As competitors ramp up their content spend… users will spend less time on TRC. Thereby, reducing its value proposition.

We’ve already shown that The Roku Channel was a top 5 streaming app on Roku for four straight quarters.

We’ve also shown the success Roku has had with Quibi content and its first original feature film, Zoey’s Extraordinary Christmas.

But at the end of the day, it’s not trying to compete with the likes of Netflix, Disney+, Apple TV, etc…

There’s a paradox amongst the streaming platforms.

They are in a never-ending death spiral of spending billions on original content.

Yet somehow, we all find ourselves looking for something to watch when we finish our favorite shows.

This meme perfectly sums it up. I know you’ve thought this before:

(source: imgflip.com)

Netflix spent close to $20 billion on content… yet there’s still “nothing to watch.”

Who fills that void?

Roku.

Roku solves the paradox.

The paradox of: “Where can I watch something, anything, until my shows come back.”

That’s Roku’s unique value proposition.

And it works.

Roku was a top 5 app on the platform in the U.S. by active account reach for the third quarter in a row. And for the first time, it was a top 5 app on Roku’s platform in The U.S. by streaming engagement.

Here’s Wood:

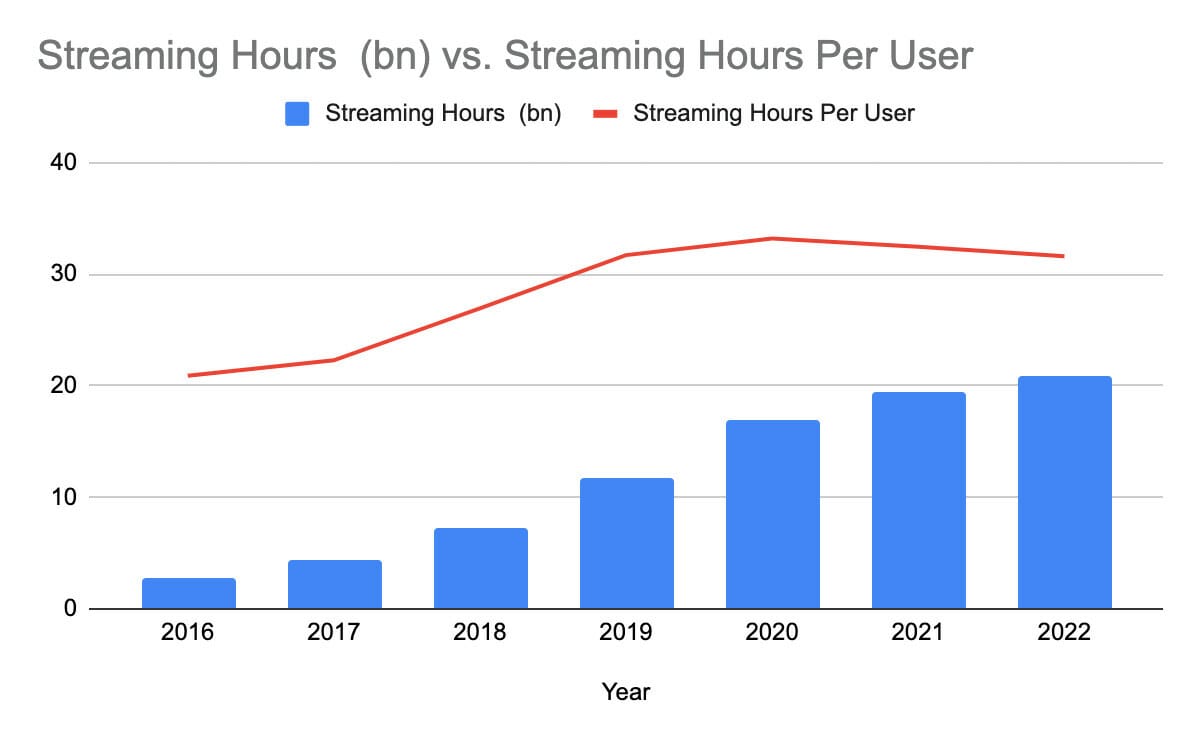

“We've talked about the stat that if you look at the number of hours viewed by a typical household in the U.S., which is about 8, and you compare that to Roku's hours, we're about half of that. So there's -- and that's because consumers are using other ways of watching TV besides just streaming, but they're switching more and more and more of their time to streaming, and so that's causing streaming hours overall to grow.”

Roku doesn’t break out data per streaming service. But TRC is top five by active account reach and streaming hour engagement in a growing pie that is streaming.

Here’s Wood again on their Q1 ‘22 call:

“If you look at Roku as a platform, there's lots of different services that consumers can select to stream from. Streaming has never been more popular. The viewers have just a tremendous number of options. And so -- and that's causing overall engagement across our platform to grow. Any particular service might be going up or down or whatever has some specific dynamics, but in aggregate, we're seeing streaming grow.”

The point being Roku has a natural tailwind behind it.

Streaming viewers are always looking out for something to watch. Roku is there when the top streaming services have lulls in their programming.

Meanwhile, TRC continues to build enough of a library where streamers are going to them. This couldn’t work better for Roku.

Let the streaming services spend hundreds of billions on original content… and Roku’s The Roku Channel still reaches top 5 as a streaming app.

9) The Biggest Tailwind To Streaming Hasn’t Happened Yet: E-commerce

Transaction based video on demand (TVOD) will be the biggest catalyst to streaming. We’re barely in the first inning of this transformation.

You see, e-comm has a whole different set of key performance indicators (KPIs) than traditional TV advertising: add to cart, cart abandonment, checkout, etc…

E-commerce ad spend is in the hundreds of billions of dollars.

Imagine if George Clooney or Ryan Reynolds promoted their tequila brands and then offered you a 10% discount to buy right then and there?

Or imagine if Tesla runs a campaign for a Model 3 about taking new deposits. Viewers who put their deposit down via the ad can do so for $500 instead of the standard $1,000.

Or imagine you’re watching Steph Curry or LeBron James promote their new sneaker debuts during an NBA game. Either in game or during a commercial.

Nike’s advertising creativity becomes unlimited.

First, they know who likes basketball. Professional basketball more specifically. Roku knows your age and gender. And will eventually start to understand your purchase frequency and propensity to buy from certain types of ads (static, video, interactive).

Nike can run dozens of different types of ad campaigns to track general awareness (i.e. impressions), clicks, add to cart, cart abandonment, purchases, return on ad spend (ROAS) metrics, etc…

Whatever Nike spends now on TV ad placements is a fraction of what this new world looks like.

And that’s just one example. We could take this road much further.

Layer on membership benefits. Upselling. Cross-selling.

That’s the power of laying on e-commerce ad spending on top of streaming TV.

Roku is starting to do this now. But it’s in its infancy.

Roku has the first-party data. And the credit card is on file to make purchasing easy.

Here’s just a taste of what advertisers are starting to realize. From Roku’s Q1 ‘22 Shareholder Letter (emphasis added):

Neutrogena, a Johnson & Johnson skincare brand, leveraged our shopper data program to reach consumers that are no longer on legacy pay TV and to measure the impact on sales. The advanced targeting and measurement that only Roku can provide in TV streaming resulted in Roku users who saw the ad campaigns spending 4.2x more on Neutrogena towelettes than the average Kroger household.

Roku is going all in here. They know the opportunity in front of them. They partnered with Shopify back in September to offer such services.

Back in September, Roku announced a new app that will, “allow Shopify merchants to easily build, buy, and measure TV streaming advertising campaigns. Roku’s addition to Shopify’s marketing solutions will become the first-ever TV streaming app available in the Shopify App Store, opening the door to small and medium-sized businesses (SMBs) to build stronger brands and increase revenue through TV advertising. Designed for merchants to use on their own and with limited ad budgets, Roku’s platform has already shown it can be effective, lifting consideration for one advertiser’s brand by 63%.”

Just wait till the integration is available when the user purchases the product… and it automatically gets shipped to their door in two days.

This is Amazon’s and Google’s dream. It’s why they’re now spending tens of billions of dollars trying to catch up to Roku.

(And what makes Roku a prime acquisition candidate although we prefer Roku to remain independent and not sell.)

Because of the opportunity e-commerce presents.

We’re talking hundreds of billions of dollars per year.

Roku has compounded its ARPU by 35% over the past five years. And that’s with e-commerce barely in the first inning in this shift to streaming.

It’s what gives us confidence that Roku’s revenue will continue to grow at high rates for years to come.

Okay, we’ve already hit approx. 3,500 words. So we’ll have to extend Roku’s Thesis Debunked into a Part III.

In it, we’ll cover:

Why Roku’s Supply Chain Are One-Time Solvable Problems

Why Roku Can/Should Survive/Benefit During Recessions

Why Roku Benefits From Apple/Google Cookie Deprecation

Until then…

Good investing,

Lance