“Charlie and I are not stock-pickers; we are business-pickers.”

It was the same takeaway this year as it was all previous years.

Warren Buffett wrote yet another letter teaching investors and readers what the formula was to long-term investing success. (You can read Buffett’s 2022 letter here.)

Hold on to good businesses. Don’t sell. Let compounding do its thing.

Long-term investing isn’t a revolutionary idea. It’s just one that’s difficult to master.

We’ve written about the success of long-term investing too (You can read about it here). The reason long-term investing works is due to compounding.

Here’s what we said:

“Compounding only works with time.

Your chances of losing money pretty much go to zero if you hold long term, too.

Most investors know this… yet they can’t help but get in their own way. The average holding period of a stock is six months.

The result of our erratic behavior to buy and then sell leads to a three percentage point underperformance relative to the S&P 500, according to a 2012 DALBAR Institute study.”

Buffett & Munger haven’t compounded Berkshire Hathaway’s stock price at double-digit rates over the past few decades because they were good stock pickers. It was because they never sold.

Here’s Buffett on his admission of being “mediocre” (emphasis added):

“At this point, a report card from me is appropriate: In 58 years of Berkshire management, most of my capital-allocation decisions have been no better than so-so. In some cases, also, bad moves by me have been rescued by very large doses of luck.

Our satisfactory results have been the product of about a dozen truly good decisions – that would be about one every five years – and a sometimes-forgotten advantage that favors long-term investors such as Berkshire.”

The takeaway here is that the majority of investors’ long-term performance is decided by just a handful of companies.

Big winners always make up for the amount of losers in one’s portfolio. Buffett is admitting as such. It’s also the math venture-capitalists (VCs) use when investing.

We investors just aren’t very good at getting out of our own way. Many of us don’t know the game we’re playing. We don’t Know Thyself.

We’re fortunate to have Buffett remind us about the power of compounding each and every year. He gave a few examples, too (emphasis added):

“In August 1994 – yes, 1994 – Berkshire completed its seven-year purchase of the 400 million shares of Coca-Cola we now own. The total cost was $1.3 billion – then a very meaningful sum at Berkshire. The cash dividend we received from Coke in 1994 was $75 million. By 2022, the dividend had increased to $704 million. Growth occurred every year, just as certain as birthdays. All Charlie and I were required to do was cash Coke’s quarterly dividend checks. We expect that those checks are highly likely to grow.”

Berkshire’s dividends from Coke grew by 10x over the past 28 years. Berkshire’s now receiving a 54% yield on its cost basis every single year. Which doesn’t include any potential increase in dividends.

And we’re not even talking about Coke’s share price increasing roughly 15x over the past 28 years.

Buffett & Munger didn’t do anything special. In fact, Buffett admitted they didn’t do anything. Just “cash Coke’s quarterly dividend checks.”

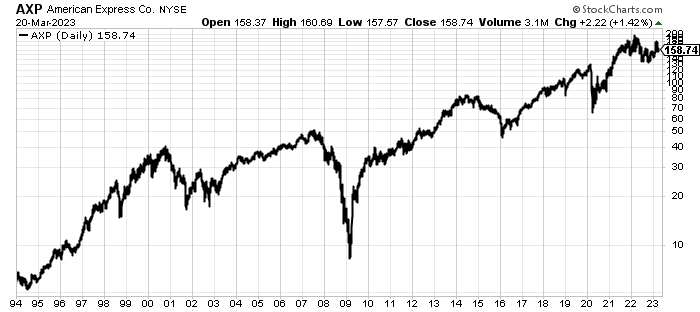

He gave American Express as another example to drive home the point.

“American Express is much the same story. Berkshire’s purchases of Amex were essentially completed in 1995 and, coincidentally, also cost $1.3 billion. Annual dividends received from this investment have grown from $41 million to $302 million. Those checks, too, seem highly likely to increase. These dividend gains, though pleasing, are far from spectacular. But they bring with them important gains in stock prices.”

Berkshire’s dividends are now a 23% yield on cost 28 years later. Not as great as Coke. But I don’t think anyone reading this would complain.

Meanwhile, American Express (AXP) is also up approximately 15x.

He then goes on to prove the point of compounding and winners outshining the losers. The secret sauce (emphasis added):

“At yearend, our Coke investment was valued at $25 billion while Amex was recorded at $22 billion. Each holding now accounts for roughly 5% of Berkshire’s net worth, akin to its weighting long ago. Assume, for a moment, I had made a similarly-sized investment mistake in the 1990s, one that flat-lined and simply retained its $1.3 billion value in 2022. (An example would be a high-grade 30-year bond.) That disappointing investment would now represent an insignificant 0.3% of Berkshire’s net worth and would be delivering to us an unchanged $80 million or so of annual income. The lesson for investors: The weeds wither away in significance as the flowers bloom. Over time, it takes just a few winners to work wonders. And, yes, it helps to start early and live into your 90s as well.”

At Mighty, our goal is to continue to let our Trophy Assets bloom (you can take a peek into our Trophy Asset strategy here.)

That’s it. That’s Buffett’s “Secret Sauce.”

The world seems like it’s on the brink of collapse… again. There’s always something to worry about.

Politics. Geopolitics. War. Famine. Etc…

Yet the world has a funny way of not ending.

The only thing you need to do is hold on… and let great businesses work their magic.

Good investing,

Lance