Pension systems are supposed to be “safe,” right?

Work for decades. Put money into the respective pension plan. And get promised an expected annual return — usually 7% — after X number of years.

The managers running the pensions are supposed to be good stewards of capital.

There’s an embedded trust between pensioners and the people managing their $35-$40 trillion in assets.

The trust is not to risk too much because it’s people’s retirement money. So most pensions have mandates to invest a large percentage in safe assets (like bonds), and some in stocks. Pension mandates usually follow some sort of traditional 60/40 bond-equity ratio.

But it turns out pensions systems levered up and took on as much risk as retail traders due to the global central bank policy of 0% and, of course, negative interest rates.

Here’s what we said back in July 2019 (emphasis added):

“Interest rates pushed to zero and negative [rates] forced hundreds of billions - even trillions - of dollars into safe assets. Bond prices went up. Yields went down.

The question today still remains - where do pension funds invest to earn 7%?

U.S. Treasury yields aren't it. 10 year bonds earn 2%. 30 year treasuries earn 2.5%. Top rated corporate bonds aren't much better. Sovereign bonds around Europe and Japan are negative.

This means pension funds have to ‘reach for yield.’

They're investing in junk bonds - all in search for yield. Whether that's a company with shaky finances. Or a local, state, national bond - like Turkey - with high yielding interest.

Most pensions would avoid Turkish bonds. But not all...

This is why U.S. pensions are roughly 70% funded - closing in on $1 trillion total. They can't "safely" earn 7% year-over-year to pay out what they've promised.

The California Public Employees' Retirement System, CALPERS - one of the largest U.S. pensions with $375 billion in assets - has over $130 billion in unfunded liabilities.

Stocks have been their savior. But how long do we think that's going to last? Pensioners around the country are in for a rude awakening. They're having to work longer or see their pension checks cut.

We're already seeing it today.

Here's a recent article from PBS: ‘More than half the states in the U.S. now require people to work longer or retire later before they can claim their benefit. For example Colorado, which overhauled its pensions earlier this year, raised the retirement age for new hires after 2020 to 64 years, from 60 and 58 for state employees and teachers, respectively.’

Pushing yields down forced everyone to hunt for yield.

Now there is none. If you have a pension, check its prospectus. You might not want to get all of your retirement income from the pension.”

That was back in 2019.

Today is way more bleak — meaning pensioners are in an even worse position.

Pensions Are Losing Money Hand Over Fist

CALPERS’ $442 billion pension fund lost $60 billion in 2022 through July.

$60 billion…

They then had to unload $6 billion in their private equity investments at a 10%+ discount because of the volatility.

From Bloomberg (emphasis added):

“CALPERS sold its holdings at a roughly 10% discount to their value in September 2021, some of the people said. The fund softened the blow thanks in part to how it structured the deal, they said.

The haircuts for various assets sold by CALPERS range from high single-digit percentages to about 20%, some of the people said…

CALPERS, like many public pensions, doesn’t have all the assets needed to meet future promises to retired police, firefighters and other state workers. If the funds can’t meet their return benchmarks, it puts the onus on taxpayers to help fill the shortfall.”

It’s not just CALPERS. It’s every pension.

From Bloomberg (emphasis added):

“Steep stock and bond losses are set to leave state and local pensions this year with enough to cover 77.9% of all the benefits that have been promised, down from 84.8% in 2021, according to the New York-based nonprofit Equable Institute. That reflects almost a half trillion dollar increase in the gap between assets and what’s owed to retirees.

Public funds lost about 10.4% on average in 2022, according to Equable Institute

“The threat to states is not the investment losses,” said Equable executive director Anthony Randazzo. “The threat is the contribution rates that are going to have to go up because of the investment losses.”

According to Bloomberg data, roughly $15 trillion in value has been lopped off U.S. stocks since last November.

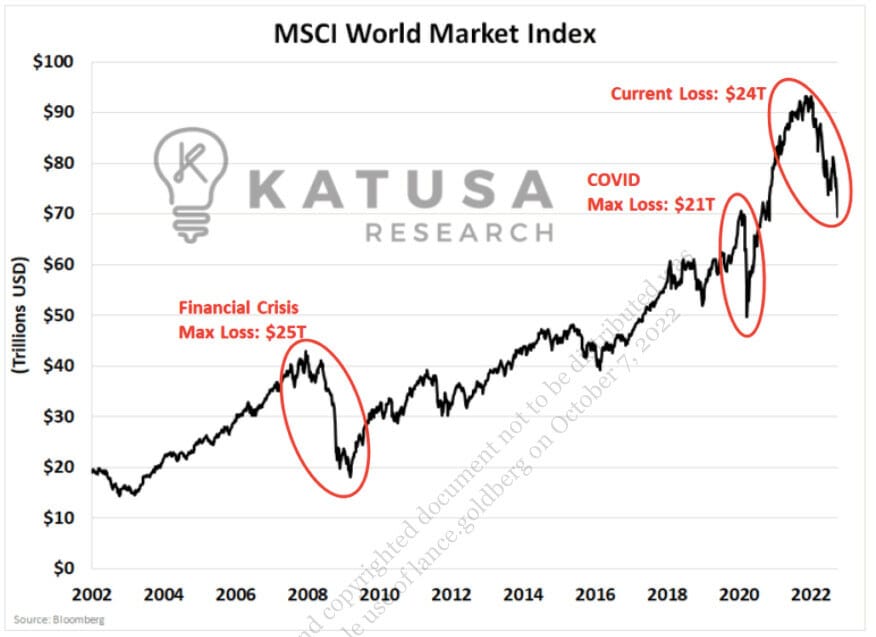

Globally that number is $24 trillion in lost equity value (excluding China).

The “60/40” portfolio of stocks and bonds is on pace to log its worst performance since 1931.

Bonds are off to one of their worst starts ever. So bad, the Barclays US Aggregate Bond Index had a “4-standard deviation event” away from normal between August 2021 and June 2022.

It’s not just U.S. pensions that are getting clobbered.

Things got so bad in the U.K., that 90% of all pensions were on the verge of being insolvent… until the U.K. central bank had an 11th hour bailout earlier this month.

From Substack blog Market Sentiment (emphasis added):

“Pensioners in the UK faced the unimaginable on Thursday. They saw their life savings nearly disappear when the bond market went into pandemonium, after an eccentric and sudden policy change by the government. 90% of UK pension funds would have been wiped out…

In this case, pressure to show better returns on the balance sheets drove UK pension fund managers to take on leverage by investing in Liability-Driven Investments (LDIs). These are derivative instruments that use the assets they own as collateral. As gilt prices dropped, pension funds started to get margin-called, and the situation would have spiraled out of control quickly if the Bank of England had not intervened.2”

The U.K. central bank had to step in for the bailouts. But at a cost of its currency and its bonds plummeting to multi-decade lows.

Things aren’t much better elsewhere.

Norway’s sovereign wealth fund, the largest in the world, had a loss of $174 billion in the first half of 2022.

Denmark’s pension system is getting crushed too.

But not because of things out of the pension managers control. They intentionally took on risk with pensioners’ money.

The point of this post isn’t to scare you with another piece of bear porn.

It’s to shine a light on the malfeasance of economic policy by the so-called experts we call central bankers. And the pension managers who are — have been, and were — gambling with millions of pensioners’ retirement funds.

It’s unfortunate. But this is what happens when the world of finance gets distorted with economists and academics, who start pulling levers by testing unproven economic theory.

The world has been built on 0% interest rates since 2008. Now it has to adjust to a higher interest rate world… creating massive disruptions and instability.

To a point where the U.K. pension system almost went belly up in a Lehman Bank type moment.

The late economist Hyman Minsky once said:

‘‘Stability leads to instability. The more stable things become and the longer things are stable, the more unstable they will be when the crisis hits.’’

Pension managers took unnecessary risk — and leverage — trying to do right by the pensioners.

Instead they put millions of retirees’ and future retirees money at risk. And lost billions in the process.

The Takeaway

The world of “stable” zero interest rates is over. That is what’s making 2022 one of the worst on record across pretty much every asset class you can think of.

That’s what’s creating instability.

We’ve been preaching for months that the Federal Reserve is hellbent on bringing down inflation. They’ve told you they don’t care how much wealth they destroy of yours. They won’t stop until inflation is down to 2%.

We continue to warn clients and readers to step aside and let the knife fall. Yet investors continue to get their hands bloodied trying to be the hero.

Don’t be one of them.

We’ll get our chance to invest in the best companies in the world — Trophy Assets. They’re one of the best and easiest ways to outperform the market.

But we have to be patient.

Our advice remains the same. Exercise extreme caution investing in today’s market. Hold your Trophy Assets and let compounding do its magic. Have enough cash to let you sleep well at night. Continue to be patient and let the knife fall.

The returns coming out of this will be incredible. You just have to be able to survive first.

Good investing,

Lance