Investors need to remember that the markets are forward looking.

They’re sort of a prediction model. Made up of millions of participants. All with different opinions on what the short-term future beholds. More specifically, what they think a particular business will generate in revenue and profits in the future. And then discount them back to today.

No one can accurately predict the future… but taking millions of predictions (on a company’s share price) gives you better insight into a single one (your own prediction of what the company is worth).

It’s why you should use a company’s stock prices as a signal (although, not the signal. Or the only signal) of what the short-term future beholds.

You should always ask yourself, ‘Why is this stock up or down?’ ‘Is there something I’m missing?’

Take any stock in the real estate sector.

Homes continue to sell for record prices… Yet real estate stocks continue to hit new lows.

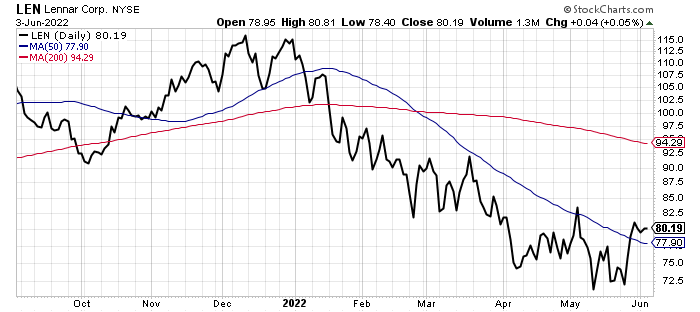

Homebuilders like D.R. Horton (DHI), Lennar (LEN), PulteGroup (PHM), and NVR (NVR) — parent to Ryan Homes — are all around 30%+ off their highs.

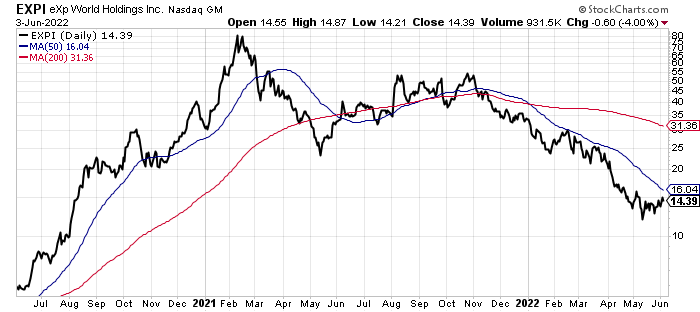

Real estate brokerage companies like eXp World Holdings (EXPI), REMAX (RMAX), and Realogy Holdings (RLGY) — parent to Coldwell Banker, Corcoran, and others — are all down around 45-70% off their highs.

iHome buyers Zillow (ZG), Redfin (RDFN), and Opendoor (OPEN) are all down 80-90% from their highs.

Every one of these companies (except for the iHome buyers) are crushing it right now. Everyone is hitting multi-year record sales and/or profits.

Take NVR — a Mighty Trophy Asset candidate — for example.

Revenues are at all-time highs. They’re just over $9 billion for the trailing 12 months — more than $3 billion higher compared to the housing bubble peak.

Revenue growth in 2021 was faster than its 2006 peak. Gross profit margins are at all time highs. Net income margins, too.

NVR has also announced more than $1.5 billion in share buybacks just in the past 7 months alone. Yet its stock is down around 25% off its highs in December.

Lennar is in the same boat.

Revenues are nearly double that of its 2006 peak. Gross profits are almost 3x. And yet its share price is off more than 30% from its highs.

Real estate brokerage firm eXp is another example.

Their #1 KPI (key performance indicator) is realtor growth.

eXp realtors have grown from 6,500 to nearly 80,000 over the past 5 years. Their revenues have grown from $156 million in 2017 to $4.2 billion in the trailing 12 months. They’ve now hit $1 billion in revenue in the past three quarters alone.

But their stock is down 80% from its 2021 highs.

By all accounts, eXp’s business has never been better.

But the question is… what gives?

These businesses are doing the best they’ve ever done by a mile… and yet investors don’t want anything to do with these companies.

Because the markets are forward looking, they don’t care what the company has done in the past. They want to know how the company is going to operate in the future.

It’s not hard to see these businesses will slow down with mortgage rates at 5% today versus 2% just 12 months ago.

We wrote about this on April 19th in our post Why Mortgage Rates Are Rising:

“Banks went from offering new homeowners 2.80% fixed rate interest mortgages to now asking for 5%. We haven’t seen above 5% yields since 2011.

This means new homeowners’ mortgage payments have gone up almost 80% in just the past few months.

New homeowners looking to buy a $500,000 house now have to pay an additional $700/month on their mortgage due to the higher rates.

How high mortgage rates will go will depend on how high the Federal Reserve raises its rates.

But the knock-on effects are many.

For starters, that $700/month prices out new prospective homebuyers in many neighborhoods. They simply can no longer afford as much ‘house.’

About 56% of Americans can’t afford a $1,000 emergency expense. So assumingly, they can’t afford an extra $700/month either.”

Housing inventory is still at multi-year lows. Meaning the supply/demand imbalance is still intact. But things are slowing down fast.

Houses are sitting on the market longer. Price cuts are happening more frequently. There aren’t 50 buyers per house anymore.

You’re likely seeing or hearing about the slowdown in housing across the country.

Down here in Delray Beach, Florida, inventory is up over 26% in just the past 66 days, according to local realtor, John Wieland (aka Mr. Downtown Delray).

Anecdotally, we’ve heard similar rumblings from our friends and family in Baltimore, Philadelphia, New York City, Boulder, etc…

Even the hottest markets in California are seeing a slowdown.

You see, it’s not about the total supply/demand function that investors care about in the short term.

It’s the rate of change that scares most investors (a.k.a the delta). And leads to a re-pricing of stocks.

Long-term real estate investors can look at this chart and know there’s still a long secular tailwind at their backs:

This should tell you all you need to know about the sector. Yet the carnage in real estate stocks has already happened.

Why? Because it’s all about the delta.

Mortgage rates pretty much doubled overnight. Most people who wanted to move over the past two years have done so already. And anyone looking to move now doesn’t want to pay 5% rates when they’re locked in lower today.

So investors are assuming a significant slowdown over the next twelve months.

What multiple are you willing to pay if mortgage rates remain elevated for longer? What multiple are you willing to pay for a company that you assume will slow down for the foreseeable future? What multiple are you willing to pay if that foreseeable future is unknowable in and of itself? Especially in one of the most cyclical industries tied to U.S. Treasury yields?

The stock price is telling you what investors think the answers to those questions are.

Because it’s not about what the company has done in the past. It’s about what’s expected in the future.

You buy based on the future revenues and profits of that company. The past is used as a baseline of what to project in the future. But not because of what it’s done in the past.

However, this is where your opportunity lies as an investor. The mismatch of future expectations.

The average holding period of investors is less than a year — including many mutual funds.

Simply being able to hold for years gives you a distinct edge over most investors.

Let’s look back at NVR.

Yes, it’s down 25% from its all time highs. But look at its share price over the past 20 years.

It’s up almost 30x.

You can see multiple drawdowns of 20-25% over the past 20 years. Including a 60%+ drawdown during the Great Financial Crisis. Yet the long-term holder who held is now very wealthy.

Investors right now don’t like what the near future holds for NVR. Or any real estate stocks for that matter. But for those looking beyond 12-24 months for NVR should be rewarded if history is any guide.

Most of everything is down these days. But you should continue to hold your Trophy Asset companies for the long-term. Don’t interrupt the compounding process.

We echoed that sentiment April 26th in our post What Do We Do Now?:

“Inflation. War. Geopolitical tensions. Elections. Recessions.

There’s always something to worry about. There’s always something that makes us want to hide in the bunker.

And yet, long term, the market rises.

The old adage at my former financial publishing firm was “the world has a way of not ending.”

It means you should be invested no matter what…

Because, truth is, you can’t time the market. Even if you can predict what’s going to happen, you can’t predict the real probabilities. Or the second or third order consequences. (Think: The markets booming because of COVID in 2020.)

Historical data suggests you shouldn’t touch your portfolio. Interrupting the effects of compounding crushes your long-term returns. So doing nothing is often the best move. Meaning stop looking at your stock performance everyday and potentially doing something stupid (i.e. selling).”

Stock prices are a future discounting mechanism. Meaning they’re a pretty good signal of what investors think will happen to the business in the near term.

The market likely knows everything you also know about the company. So your expectations of the near term should be re-evaluated based on what the stock price is showing.

But the market is made up of millions of emotional people (and computers) who make irrational decisions based on short-term prospects.

This is where you can get your edge. By being able to look through the short-term business prospects and hold on for the long term.

That’s your edge as an investor. Look to take advantage of it now, considering that stocks have been crushed.

Good investing,

Lance

P.S. Longtime readers and clients know we continue to preach caution in the markets. We still think the probabilities skew to the downside. So, of course, adding to Trophy Stocks should be done so with proper position sizing and asset allocation methods.

P.P.S. We want to hear from you. What are some companies you plan on buying and holding for the next 20+ years?