Bed Bath & Beyond (NASDAQ: BBBY) has been in the news almost every day since we highlighted them as a flawed company you should avoid at all cost on August 2nd.

BBBY shares soared 300% right after we published our note.

(They’ve fallen 56% from the highs… but are still up almost 100% from our note.)

Did something change? Did we miss something? Is Bed Bath & Beyond a better company than we give it credit for?

Not exactly.

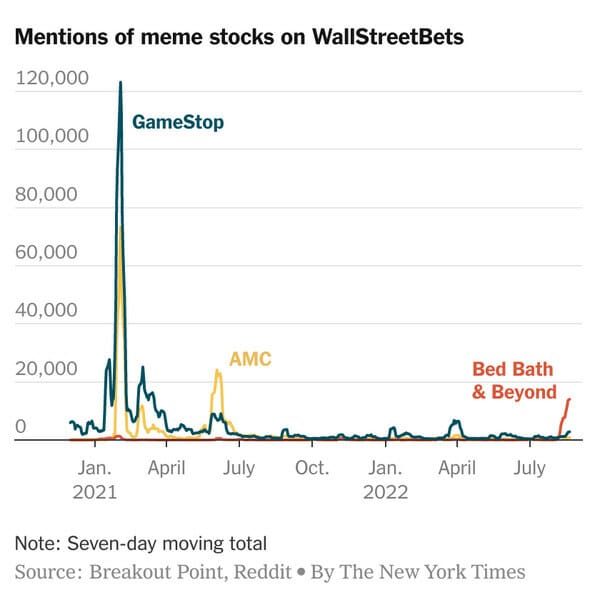

Bed Bath & Beyond has been one of the primary “meme” stocks like GameStop and AMC.

Retail investors target the most shorted stocks in the market… and try to squeeze out the short sellers by buying call options — aka creating a “gamma squeeze.”

BBBY became one of the favorite meme stocks this month after former Chewy CEO Ryan Cohen gave an updated disclosure of his BBBY holdings.

BBBY’s share price soared 300% on the news.

It continues to be in the news — mainstream and social media alike — regularly as investors watch the stock price.

But things continue to get worse underneath the hood.

Suppliers aren’t getting paid. So they’re starting to halt shipments to BBBY altogether.

From Yahoo! Finance (emphasis added):

“Some Bed Bath & Beyond suppliers are restricting or halting shipments altogether after the home-goods retailer fell behind on payments, according to people familiar with the matter, complicating the company's scramble for liquidity...

A survey of vendors done by Pulse Ratings, an independent credit-rating and consulting firm, found that Bed Bath & Beyond was in arrears with all respondents, with some saying that more than half of their accounts receivable with the company were past due. The payments were late by as much as 90 days, the vendors said in the survey seen by Bloomberg.”

Bed Bath & Beyond isn’t just strapped for cash. They’re burning it at a fast rate.

From Bloomberg:

“The company had about $108 million in cash and equivalents at the end of May, down from $1.1 billion a year earlier…

Bed Bath & Beyond is mired in a deep sales slump, and its bonds change hands for less than half of face value amid concerns that the retailer’s turnaround effort has stalled.

Bed Bath & Beyond’s senior unsecured notes due 2024 trade around 41 cents on the dollar, according to Trace. Moody’s Investors Service slashed the company’s credit grade three notches to Caa2 last month, citing the impact of steep revenue and earnings declines on liquidity, cash flow and debt metrics.”

Bond prices tell you a lot about the finances of a company.

Bond investors only have to worry about one thing: Will they get their money back when the bond matures? Nothing else matters. So the fact that BBBY bonds — which mature less than 2 years from now — trade at 40 cents on the dollar is a major red flag.

It signals the end is near. Bankruptcy looms.

Of course Bed Bath & Beyond doesn’t want to go out of business. So management is doing what any management should: Raise capital from the credit market.

This is their only lifeline left. And a last hurrah before what will likely and inevitably be a bankruptcy.

That lifeline looks to have come fromJPMorgan Chase. As stated in the Wall Street Journal (emphasis added).

“The company on Tuesday told prospective lenders that it has selected a lender to provide a loan following a marketing process conducted by JPMorgan Chase & Co., people familiar with the matter said.

A loan deal would provide liquidity and give vendors confidence they can continue to ship goods to Bed Bath & Beyond, which is fighting to correct missteps from an ill-fated push into private-label brands. The retailer had been seeking about $375 million to pad its cash levels and help pay down existing debt, The Wall Street Journal previously reported.

The size and structure of the final deal wasn't immediately clear on Tuesday. Bed Bath & Beyond and JPMorgan didn't immediately respond to requests for comment.

The company's shares skyrocketed last week on a burst of interest from individual investors but have been sliding since billionaire activist Ryan Cohen announced his exit from the stock and sold off his 10% stake. The falling share price narrowed the options available to Bed Bath & Beyond to build liquidity, staunch its cash bleed and ensure continued shipments from suppliers.

The company has signaled it has to raise cash. While it has said it should be fine for a year, its business remains in decline. The company used up more than $500 million in cash in the latest quarter ended in May.

Bed Bath & Beyond has said it would provide an update on efforts to strengthen its balance sheet at the end of the month.”

Will $375 million be enough to turn Bed Bath & Beyond around?

That remains to be seen. The terms of the deal weren’t disclosed. But a company priced for bankruptcy probably didn’t get favorable ones.

However, management is doing what it must to stay alive.

But it’s fighting a battle that can’t be won… because the business model is flawed.

We continue to recommend you avoid BBBY at all costs.

Good investing,

Lance